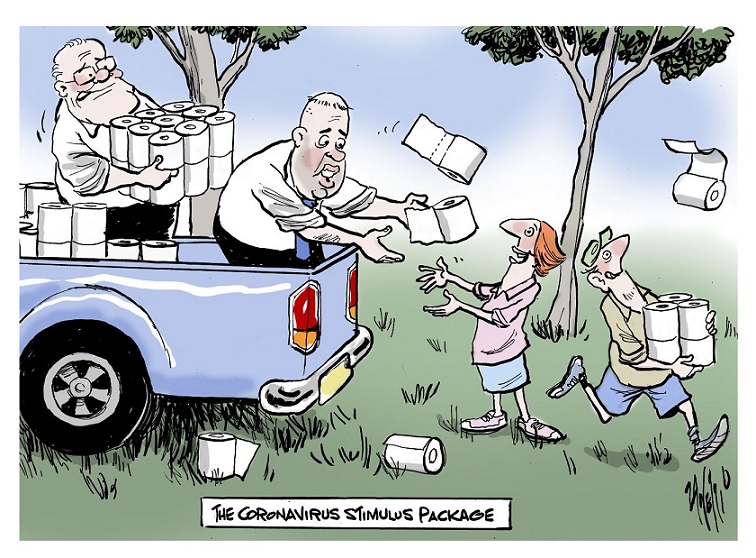

Roll up Roll Up and wipe your troubles away!

The Socialists will be hoping for a HANDOUT they can waste on grog, drugs, pokies, fast food to make them sick, and other waste.

But the ScoMo Govt won't follow Labor's Ruddical incompetency here.

Government prepares to spend billions amid recession fears

Phillip Coorey, John Kehoe and Matthew Cranston Updated Mar 5, 2020 — 7.19am, first published at 12.01am

Scott Morrison and Josh Frydenberg are preparing to spend billions to try and ward off recession. Dominic Lorrimer

The Morrison government harbors real fears Australia is at risk of falling into recession from the coronavirus, as it prepares a multibillion-dollar economic stimulus package which will focus heavily on tax relief measures.

The Reserve Bank of Australia estimates the coronavirus impacts on education and tourism exports has already slashed Australia's economic growth in the first two months of this year by 0.5 of a percentage point.

That's on top of the bushfires subtracting about 0.2 of a percentage point off growth.

RBA deputy governor Guy Debelle told a Senate committee on Wednesday night the bank had analysed visa and students numbers and expected a 10 per cent drop in activity already with a month still to go in the March quarter.

Big business groups said one of the Morrison government's tax breaks to be included in the imminent stimulus package, a business investment allowance, must be as broad-based as possible to be effective and not subject to low spending caps, or limited to investment above normal levels.

Small business is calling for direct cash injections, tax forgiveness, and wage assistance to ward off forecast cash flow problems.

The government stimulus package, set to be announced next week and which will target jobs, small business cash flow and capital investment, will come at a cost of "billions'' to the federal budget, sources confirmed.

Inside government there is now a view Australia was at ''real risk of recession''.

Likely deficit

As the government continues planning for the May budget in parallel with the stimulus package, ministers have also been told to curtail new spending requests to protect the “structural integrity” of the budget after the coronavirus stimulus and bushfire relief is deployed.

This is a recognition the budget is now most likely to fall into deficit and Prime Minister Scott Morrison wants to maximise the chance of recovery once the crisis has passed.

Market economists are calling on the government to quickly pump an initial $4 billion into the economy to cushion the coronavirus downturn, because the economy's growth will probably be negative in the March quarter.

Following a phone hook-up on Wednesday night with the International Monetary Fund, Treasury secretary Steven Kennedy will on Thursday reveal his department's estimate of the hit to economic growth for the March quarter as a consequence of the bushfires and the coronavirus outbreak.

There's no point giving people money if businesses have nothing to sell them.

— Government source

Treasury has already warned the fires would reduce growth for the March quarter by 0.2 per cent and Treasurer Josh Frydenberg warned the additional impact from the coronavirus would be "substantial'', an upgrade from his previous assessment of ''significant''.

The fragility of the situation was exposed on Wednesday when national accounts figures for the December quarter, which was relatively unaffected by the fires and not affected by the virus, showed the economy grew by 0.5 per cent.

Supply-side hit

Finance Minister Mathias Cormann said the coronavirus would have "a material impact on economic growth over the next two quarters''.

If both quarters were negative, that would constitute a recession – the first since Paul Keating's infamous "the recession we had to have" in 1990-91.

The Morrison government stimulus package, which has grown in scale over the past week, will focus on tax measures to address what is viewed as a supply-side hit to the economy, rather than one of demand.

For this reason, the government will not be handing out cheques along the lines of the cash handouts Labor distributed in 2008 during the global financial crisis.

"There's no point giving people money if businesses have nothing to sell them,'' said a source.

December's mid-year budget update lowered the projected budget surplus to $5 billion for 2019-20, but the forecast surplus is now expected to slide into a deficit.

Mr Morrison has signalled that he wants any deficit to be temporary, without recurrent spending after the crisis passes.

He wants to avoid repeating the perceived mistakes of the Rudd government baking in higher permanent spending into the budget over the medium term after the 2008 global financial crisis passed and the economy recovered.

New investment

An exception could be the business investment allowance, which was originally slated for the May budget, is all but certain to be brought forward to next week.

The allowance, worth over $1 billion a year, offers a bonus tax deduction on new investment.

A similar scheme was introduced by Labor in 2008 during the GFC and Labor promised another similar scheme before the last election, as an alternative to a company tax cut.

When we are over this economic shock, we want the Australian economy to be stronger.

— Josh Frydenberg

Mr Frydenberg said a new scheme "is obviously under very serious consideration''.

"This is something that the business community has asked for and if you look abroad, some other countries have put in place fiscal responses which include support for business and investment,'' he said.

"We want obviously Australian businesses to get the support through this economic shock. But when we are over this economic shock, we want the Australian economy to be stronger.

"We want to have greater productivity and investment is a key part of that. So obviously that will be a focus for us."

Downside for retirees

In a proposal to the government, the Business Council of Australia said the allowance must be as broad based as possible so as to reduce complexity and not distort investment decisions.

The bonus up-front depreciation should apply to assets to be principally used in Australia for the principal purpose of carrying on a business.

It should apply to new assets that have not been installed or previously used and the policy should become effective the day it is announced.

Mr Frydenberg also said the government will reduce deeming rates for pensioners for the second time in less than a year on the back of Tuesday's decision by the Reserve Bank of Australia to cut the official cash rate to a record low of 0.5 per cent.

He said the interest rate cut, which the government demanded the big banks pass on in full – which they did – had a downside for retirees.

"I understand it is also very difficult for savers ... we are now having another look at the deeming rate.''

National Seniors Chief Advocate Ian Henschke said another cut would act as an economic stimulus.

“The top rate needs to be lower by at least 1.5 per cent and the lower by 0.5 per cent,'' he said.

"As the cash rate has dropped, the higher deeming rate of 3 per cent on savings over $51,800 is now double the typical return on a term deposit.

“To deem pensioners are earning 3 per cent is unconscionable.

https://www.afr.com/politics/federal/go ... 304-p546n1