Voters now frightened of mad crazy Labor

Forum rules

Don't poop in these threads. This isn't Europe, okay? There are rules here!

Don't poop in these threads. This isn't Europe, okay? There are rules here!

-

Bobby

Re: Voters now frightened of mad crazy Labor

We'll be well over $1 trillion in debt before Labor has reached the end of their first term -

maybe even in only 18 months.

http://www.australiandebtclock.com.au/

Govt. Debt $678 billion.

It was declared a budget emergency by Abbott at $200 billion.

maybe even in only 18 months.

http://www.australiandebtclock.com.au/

Govt. Debt $678 billion.

It was declared a budget emergency by Abbott at $200 billion.

-

sprintcyclist

- Posts: 7007

- Joined: Wed May 07, 2008 11:26 pm

Re: Voters now frightened of mad crazy Labor

shorten is ruled by the unionsPatriot wrote: ↑Tue Jan 22, 2019 5:08 pmPrediction of the disaster to come.

Once the Greenies take over control of the Senate they will demand that Labor RESTART the BOATS - just like last time.

The Greenies will also bring back the carbon tax.

Anyone who thinks that Labor will keep any of its election "Promises" is dreaming because the Greenies will change everything to what they want.

Like Gillard was just the puppet of Bob Brown Bilious Billy will be the puppet of Doc Dick.

And if Rob Oakeshott gets in all that will be missing is Tony Windsor.

There is not the slightest doubt that a Greeny controlled Shorten "Govt" will be by far the worst "Govt" in Australia's history presiding over the worst most chaotic brothel ever seen.

The Greeny controlled Labor will EASILY beat this tiny number.

And the Greeny controlled Labor will stick the boot into the hated small businesses with crippling penalty rates that will throw people out of a job.

Right Wing is the Natural Progression.

-

Patriot

- Posts: 127

- Joined: Tue Aug 14, 2018 7:22 am

Re: Voters now frightened of mad crazy Labor

Like most uninformed Lefties BRoss could not argue his way out of a wet paper bag.

Just meaningless waffle and a failed attempt to attack the much more agile poster.

But then the apathetic Lefties only know what GetUp! tells them to say and think.

Just meaningless waffle and a failed attempt to attack the much more agile poster.

But then the apathetic Lefties only know what GetUp! tells them to say and think.

-

Patriot

- Posts: 127

- Joined: Tue Aug 14, 2018 7:22 am

Re: Voters now frightened of mad crazy Labor

Ignoring the Lefties fatuous frippery and back to the TOPIC of Labor's slide.

Even the lefty Guardian is sounding the warning bells for Labor over Bilious Billy's blunders.

And while the Lefties complain about presenting the FACTS (which they fear) it is a lot quicker and easier to find an appropriate article and simply present that.

See the Lefties idea of "debate" is to simply exchange the rotting decaying contents of their minds with each other with NO NEW INFORMATION ALLOWED.

Will Bill Shorten's tax strategy make him a winner or cost him the election?

Richard Denniss Wed 23 Jan 2019 13.33 AEDT Last modified on Wed 23 Jan 2019 13.36 AEDT

For the first time in a generation, we get to vote for competing ideas on revenue collection. Get your popcorn!

Federal opposition leader Bill Shorten is seen during the launch of his "Queensland Jobs Not Cuts" bus tour in Beenleigh, south of Brisbane, January 17, 2019.

‘The best thing about living in a democracy is that the decision about whether we collect more revenue and spend more on services, or cut taxes further and spend less on services, will be made by you’ Photograph: Dan Peled/AAP

It’s time we talked about tax. Bill Shorten wants to close tax loopholes and spend more on schools and hospitals. Prime minister Scott Morrison wants to scare voters about the perils of a high-taxing Labor government. And the business community still want the Liberal’s big cut in the company tax rate, but they also want Labor’s proposed tax concessions for new investment.

While there is no agreement about what shape “tax reform” should take, there is overwhelming agreement between the major political parties that this year’s federal election will be a referendum on tax. And the best thing about living in a democracy is that the decision about whether we collect more revenue and spend more on services, or cut taxes further and spend less on services, will be made by you.

History and geography make clear that there is no “right” amount of tax revenue to collect. The Nordic countries have some of the highest tax/GDP ratios in the world and also have some of the most prosperous and cohesive societies. Many developing countries in Africa and Asia have very low levels of tax collection and some of the weakest economies in the world. If investment simply flowed to the countries with the lowest tax rates then all of the world’s cars, computers and clothes would be manufactured in tax havens like the Cayman Islands. But of course, despite their low taxes, almost nothing is produced in tax havens – beyond accounting services.

There is also clear evidence that there is no “right” way to collect the amount of tax preferred by a country’s citizens. The “lefties” in the US have a strong preference for the kind of property taxes and wealth taxes that give Morrison and treasurer Josh Frydenberg conniptions. The Tories in the UK oversee a 40% inheritance tax, which in Australia would obviously be called a “death duty” and deemed as “class warfare”. Countries as diverse as Sweden and South Korea raise revenue through carbon pricing. Norway has become rich by taxing its oil reserves while Australia has literally chosen to give much of its gas away for free, mostly to multinational companies which pay little or no company tax here in Australia.

If one thing is for sure, by May this year we will know who was completely wrong

And while there is no clear evidence about the right amount of tax to collect and the way to collect it, luckily the Australian constitution allows us to have elections to make such important decisions. After decades of the ALP and Coalition agreeing that lower taxes would deliver benefits that would “trickle down” to the broader community, we are about to have the first election in a generation where the government are keen to place competing ideas about revenue collection at the centre of their election campaigns. Get your popcorn!

Conservative commentators seem convinced that Shorten’s plans to close tax loopholes like the capital gains tax concession, negative gearing for investment properties and franking credit refunds will cost him enormously at this year’s election. At the same time the ALP’s strategists seem convinced that talking about spending more on schools, roads and hospitals that are funded by making the tax system fairer is a political winner for the opposition. If one thing is for sure, by May this year we will know who was completely wrong.

For decades political commentators, and many voters, have complained that the two major parties had become virtually indistinguishable. You don’t hear many people say that anymore. But regardless of what you think of either major party’s policies, the fact that they are offering us, the voters, a clear alternative is to be applauded.

While we will need to wait a while for the Australian Electoral Commission to tell us which vision for Australia is the most popular, early signs are ominous for the Morrison government. Shorten spelled out his proposed changes to negative gearing before the last federal election and his clamp-down on franking credit refunds before the Batman byelection, and he did much better in both contests than was expected. The Coalition have been attacking the proposed changes for years in some cases, yet they still lag behind Labor by as much as 10 points in some polls.

The Victorian state election provided another rebuke to Coalition strategists who believe that scare campaigns about Labor’s economic management are a substitute for a positive vision for the country. Daniel Andrews trounced his Victorian Liberal opponents at last year’s state election on the back of promises to spend more money on essential services and infrastructure.

Australia is one of the richest countries in the world yet as anyone who has travelled to Europe knows, our cities and our essential services are far from world’s best practice. For 30 years Australian voters have been told, by both major political parties, that if we cut taxes and public spending sufficiently, we would become rich enough to have world class services one day. Strangely it didn’t work.

Democracy isn’t perfect and it’s not quick, but it was set up to answer big questions about what we want more of and what we want less of. The ALP is doubling down on its strategy of closing tax loopholes and spending more on services. The Liberals are sticking with the importance of cutting taxes and cutting public spending. I can’t wait.

https://www.theguardian.com/commentisfr ... e-election

Even the lefty Guardian is sounding the warning bells for Labor over Bilious Billy's blunders.

And while the Lefties complain about presenting the FACTS (which they fear) it is a lot quicker and easier to find an appropriate article and simply present that.

See the Lefties idea of "debate" is to simply exchange the rotting decaying contents of their minds with each other with NO NEW INFORMATION ALLOWED.

Will Bill Shorten's tax strategy make him a winner or cost him the election?

Richard Denniss Wed 23 Jan 2019 13.33 AEDT Last modified on Wed 23 Jan 2019 13.36 AEDT

For the first time in a generation, we get to vote for competing ideas on revenue collection. Get your popcorn!

Federal opposition leader Bill Shorten is seen during the launch of his "Queensland Jobs Not Cuts" bus tour in Beenleigh, south of Brisbane, January 17, 2019.

‘The best thing about living in a democracy is that the decision about whether we collect more revenue and spend more on services, or cut taxes further and spend less on services, will be made by you’ Photograph: Dan Peled/AAP

It’s time we talked about tax. Bill Shorten wants to close tax loopholes and spend more on schools and hospitals. Prime minister Scott Morrison wants to scare voters about the perils of a high-taxing Labor government. And the business community still want the Liberal’s big cut in the company tax rate, but they also want Labor’s proposed tax concessions for new investment.

While there is no agreement about what shape “tax reform” should take, there is overwhelming agreement between the major political parties that this year’s federal election will be a referendum on tax. And the best thing about living in a democracy is that the decision about whether we collect more revenue and spend more on services, or cut taxes further and spend less on services, will be made by you.

History and geography make clear that there is no “right” amount of tax revenue to collect. The Nordic countries have some of the highest tax/GDP ratios in the world and also have some of the most prosperous and cohesive societies. Many developing countries in Africa and Asia have very low levels of tax collection and some of the weakest economies in the world. If investment simply flowed to the countries with the lowest tax rates then all of the world’s cars, computers and clothes would be manufactured in tax havens like the Cayman Islands. But of course, despite their low taxes, almost nothing is produced in tax havens – beyond accounting services.

There is also clear evidence that there is no “right” way to collect the amount of tax preferred by a country’s citizens. The “lefties” in the US have a strong preference for the kind of property taxes and wealth taxes that give Morrison and treasurer Josh Frydenberg conniptions. The Tories in the UK oversee a 40% inheritance tax, which in Australia would obviously be called a “death duty” and deemed as “class warfare”. Countries as diverse as Sweden and South Korea raise revenue through carbon pricing. Norway has become rich by taxing its oil reserves while Australia has literally chosen to give much of its gas away for free, mostly to multinational companies which pay little or no company tax here in Australia.

If one thing is for sure, by May this year we will know who was completely wrong

And while there is no clear evidence about the right amount of tax to collect and the way to collect it, luckily the Australian constitution allows us to have elections to make such important decisions. After decades of the ALP and Coalition agreeing that lower taxes would deliver benefits that would “trickle down” to the broader community, we are about to have the first election in a generation where the government are keen to place competing ideas about revenue collection at the centre of their election campaigns. Get your popcorn!

Conservative commentators seem convinced that Shorten’s plans to close tax loopholes like the capital gains tax concession, negative gearing for investment properties and franking credit refunds will cost him enormously at this year’s election. At the same time the ALP’s strategists seem convinced that talking about spending more on schools, roads and hospitals that are funded by making the tax system fairer is a political winner for the opposition. If one thing is for sure, by May this year we will know who was completely wrong.

For decades political commentators, and many voters, have complained that the two major parties had become virtually indistinguishable. You don’t hear many people say that anymore. But regardless of what you think of either major party’s policies, the fact that they are offering us, the voters, a clear alternative is to be applauded.

While we will need to wait a while for the Australian Electoral Commission to tell us which vision for Australia is the most popular, early signs are ominous for the Morrison government. Shorten spelled out his proposed changes to negative gearing before the last federal election and his clamp-down on franking credit refunds before the Batman byelection, and he did much better in both contests than was expected. The Coalition have been attacking the proposed changes for years in some cases, yet they still lag behind Labor by as much as 10 points in some polls.

The Victorian state election provided another rebuke to Coalition strategists who believe that scare campaigns about Labor’s economic management are a substitute for a positive vision for the country. Daniel Andrews trounced his Victorian Liberal opponents at last year’s state election on the back of promises to spend more money on essential services and infrastructure.

Australia is one of the richest countries in the world yet as anyone who has travelled to Europe knows, our cities and our essential services are far from world’s best practice. For 30 years Australian voters have been told, by both major political parties, that if we cut taxes and public spending sufficiently, we would become rich enough to have world class services one day. Strangely it didn’t work.

Democracy isn’t perfect and it’s not quick, but it was set up to answer big questions about what we want more of and what we want less of. The ALP is doubling down on its strategy of closing tax loopholes and spending more on services. The Liberals are sticking with the importance of cutting taxes and cutting public spending. I can’t wait.

https://www.theguardian.com/commentisfr ... e-election

- brian ross

- Posts: 6059

- Joined: Thu Apr 19, 2018 6:26 pm

Re: Voters now frightened of mad crazy Labor

Oh, dearie, dearie, me. More Tory propaganda. What a load of bullshit, hey, so-called "patriot"? The ALP will win the next federal election. You going to join Tone Rabbit in the long grass and snipe a the new ALP Government?

Nationalism is not to be confused with patriotism. - Eric Blair

-

Patriot

- Posts: 127

- Joined: Tue Aug 14, 2018 7:22 am

Re: Voters now frightened of mad crazy Labor

BRoss is so adept at presenting an argument about nothing. But then he knows only what GetUp! has told him to say and think.

Prepare for untold chaos and devastation if the Greeny controlled Labor gets in.

Already their silly unfunded rubbish and $200 billion of new taxes is collapsing around their ears. Labor are hopeless at managing the economy just as they were last time and they have the recycled failure Swanny back to guide them to disaster.

Mr Frydenberg, speaking in Sydney on Tuesday, said Labor's tax policies were a particular risk given the headwinds now evident from overseas.

"We cannot, as a country, risk Labor's $200 billion of new taxes that will hurt everybody who owns a home and everybody who rents a house. That will hurt retirees and people who are planning for retirement. That will hurt small businesses and workers in big businesses," he said.

Josh Frydenberg says Labor's tax plans will hurt the economy at the worst possible time.

"The Labor Party's answer to the global storm clouds across the international economy is higher taxes. It's the wrong prescription and they have the wrong diagnosis."

Prepare for untold chaos and devastation if the Greeny controlled Labor gets in.

Already their silly unfunded rubbish and $200 billion of new taxes is collapsing around their ears. Labor are hopeless at managing the economy just as they were last time and they have the recycled failure Swanny back to guide them to disaster.

Mr Frydenberg, speaking in Sydney on Tuesday, said Labor's tax policies were a particular risk given the headwinds now evident from overseas.

"We cannot, as a country, risk Labor's $200 billion of new taxes that will hurt everybody who owns a home and everybody who rents a house. That will hurt retirees and people who are planning for retirement. That will hurt small businesses and workers in big businesses," he said.

Josh Frydenberg says Labor's tax plans will hurt the economy at the worst possible time.

"The Labor Party's answer to the global storm clouds across the international economy is higher taxes. It's the wrong prescription and they have the wrong diagnosis."

-

Patriot

- Posts: 127

- Joined: Tue Aug 14, 2018 7:22 am

Re: Voters now frightened of mad crazy Labor

The Lefties are getting a bit jumpy now as even they can see Labor sliding as the voters learn what a disaster Labor will be, even worse than last time.

Now Labor HATES Small Business and they will smash them with everything they can find.

Labor's badly thought out socialist chaos here reminds one of their NeverBuiltNetwork disaster where nothing was costed or designed or understood.

Labor’s trust tax ‘to hit small business the most’

ADAM CREIGHTON 12:00AM JANUARY 18, 2019

Josh Frydenberg says Labor’s policy to impose a minimum 30 per cent tax on trust distributions would ‘hit around 300,000 small businesses with turnover of up to $10 million’. Picture: AAP

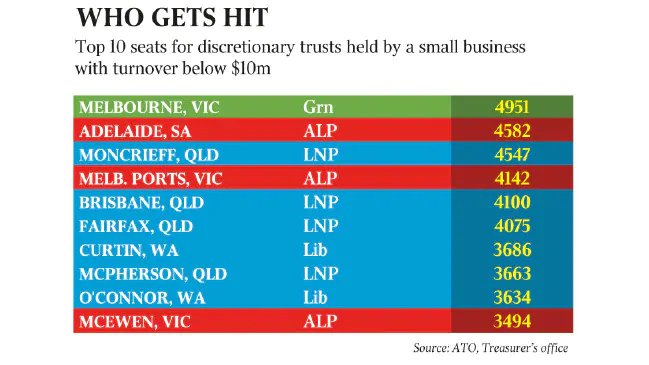

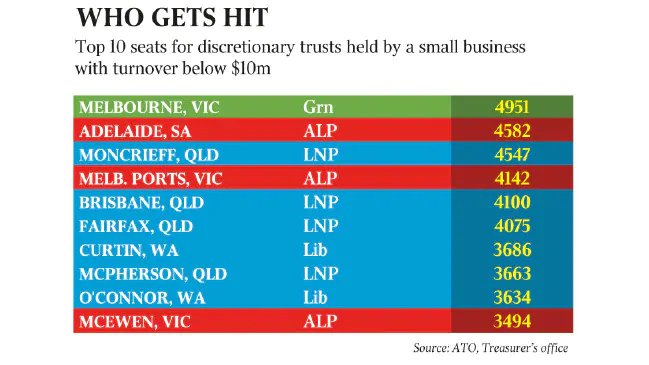

Three of the top five seats most affected by Labor’s plan to impose more than $17 billion in tax on family trusts over the next decade are Labor or Greens, according to an analysis of tax office data by the Treasurer’s office.

Labor’s policy to impose a minimum 30 per cent tax on trust distributions would “hit around 300,000 small businesses with turnover of up to $10 million” including almost 114,000 in Labor seats, Josh Frydenberg told The Australian. “This is a stark reminder how Labor’s $200bn tax hit would hurt people in their own backyard,” the Treasurer said. “Aspirational and hardworking Australians are not confined to certain postcodes or cities, they can be found in every corner of every electorate across the country.”

The Treasurer said a father and son carpentry business that made $110,000 in one year, for instance, could face tax increases of up to 180 per cent if they lost access to the individual tax-free thresholds available to each under current trust law.

“Bill Shorten, as minister for financial services and superannuation, said in 2011, ‘We don’t believe trusts are any form of tax avoidance’,” Mr Frydenberg said.

Melbourne Ports and Adelaide would be the top two Labor seats affected by Labor’s plan, each with more than 4100 trusts with turnover below $10 million. Greens-held Melbourne had the most trusts of any seat, while six of the top 10 seats that would be affected were Coalition seats, with Moncrieff in Queensland the highest in that group.

Of the 570,400 discretionary trusts in Australia, 291,200 had turnover under $10 million, of which 113,487 were in Labor seats, according to tax office statistics.

Labor Treasury spokesman Chris Bowen said 98 per cent of all taxpayers were unaffected by Labor’s trust proposal, which was announced in 2017 and was estimated to raise more than $4bn over four years.

“Labor’s reforms to the taxation of trust is simply an extension of John Howard’s work as treasurer, in seeking to apply a minimum standard tax rate of 30 per cent to discretionary trust distributions to beneficiaries over 18 years of age,” Mr Bowen said. Mr Howard in the early 1980s introduced penal levels of taxation on distributions from trusts to children; in effect stopping income-splitting to minors.

Lance Cunningham, national tax director at BDO, said Labor’s proposals were “ad hoc” and “certainly could have unintended consequences … They would probably have most detrimental effect on smaller businesses because better-off individuals use trusts and companies together to ensure their maximum tax rate is 30 per cent.

In a submission to cabinet, former treasurer Peter Costello in 1997 proposed taxing trusts as companies, according to recent archival release.

https://www.theaustralian.com.au/nation ... a1b72eaa92

And some factual accurate assessments of Labor's stupidity.

Kenneth 4 DAYS AGO

I don’t understand this furore over trusts. Profits flow through trusts and must be distributed every year to the beneficiaries who then pay tax on these earnings with minors having a very low $400 odd limit for tax free distribution over that the top marginal rate was applied. So all this rot that people go on about the tax savings are complete LIES

We don’t have a family trust but I can see why small business uses it to keep hold of their cash to counter the ebb and flows of business, if you make them pay themselves PAYG many won’t have the cash flow to function.

Simon 5 DAYS AGO

Superb analysis - the only way Labor can implement its lofty promises is to penalise taxpayers - we will all be worser off under Labor!

Pat 5 DAYS AGO

So small businesses, their trusts, their SMFS, and pensioners reviving franked dividends are to be taxed at 30%, while the franked dividends received by the industry funds - into which this kleptocratic cabal of unionists, political puppets, and apparatchiks - pour the huge amounts of super deducted from their inflated salaries, will be taxed at zero%, not 30% ?

Paul 5 DAYS AGO

Trusts just aren't what they were, already.

The swag of changes announced by Labor add up to a considerable impost on small businesses.

The belief that the owners will likely pay more tax while seemingly accurate ignores the actuality of where those taxes will come from.

Removing up to $20B a year from the economy will have consequences, many of which remain unknown.

People impacted will reduce investment. They will also seek labour cost savings, likely the ultimate sacrifice for the tax imposts. I may end up paying more tax but the ultimate source of that money will be someone or something else.

Now Labor HATES Small Business and they will smash them with everything they can find.

Labor's badly thought out socialist chaos here reminds one of their NeverBuiltNetwork disaster where nothing was costed or designed or understood.

Labor’s trust tax ‘to hit small business the most’

ADAM CREIGHTON 12:00AM JANUARY 18, 2019

Josh Frydenberg says Labor’s policy to impose a minimum 30 per cent tax on trust distributions would ‘hit around 300,000 small businesses with turnover of up to $10 million’. Picture: AAP

Three of the top five seats most affected by Labor’s plan to impose more than $17 billion in tax on family trusts over the next decade are Labor or Greens, according to an analysis of tax office data by the Treasurer’s office.

Labor’s policy to impose a minimum 30 per cent tax on trust distributions would “hit around 300,000 small businesses with turnover of up to $10 million” including almost 114,000 in Labor seats, Josh Frydenberg told The Australian. “This is a stark reminder how Labor’s $200bn tax hit would hurt people in their own backyard,” the Treasurer said. “Aspirational and hardworking Australians are not confined to certain postcodes or cities, they can be found in every corner of every electorate across the country.”

The Treasurer said a father and son carpentry business that made $110,000 in one year, for instance, could face tax increases of up to 180 per cent if they lost access to the individual tax-free thresholds available to each under current trust law.

“Bill Shorten, as minister for financial services and superannuation, said in 2011, ‘We don’t believe trusts are any form of tax avoidance’,” Mr Frydenberg said.

Melbourne Ports and Adelaide would be the top two Labor seats affected by Labor’s plan, each with more than 4100 trusts with turnover below $10 million. Greens-held Melbourne had the most trusts of any seat, while six of the top 10 seats that would be affected were Coalition seats, with Moncrieff in Queensland the highest in that group.

Of the 570,400 discretionary trusts in Australia, 291,200 had turnover under $10 million, of which 113,487 were in Labor seats, according to tax office statistics.

Labor Treasury spokesman Chris Bowen said 98 per cent of all taxpayers were unaffected by Labor’s trust proposal, which was announced in 2017 and was estimated to raise more than $4bn over four years.

“Labor’s reforms to the taxation of trust is simply an extension of John Howard’s work as treasurer, in seeking to apply a minimum standard tax rate of 30 per cent to discretionary trust distributions to beneficiaries over 18 years of age,” Mr Bowen said. Mr Howard in the early 1980s introduced penal levels of taxation on distributions from trusts to children; in effect stopping income-splitting to minors.

Lance Cunningham, national tax director at BDO, said Labor’s proposals were “ad hoc” and “certainly could have unintended consequences … They would probably have most detrimental effect on smaller businesses because better-off individuals use trusts and companies together to ensure their maximum tax rate is 30 per cent.

In a submission to cabinet, former treasurer Peter Costello in 1997 proposed taxing trusts as companies, according to recent archival release.

https://www.theaustralian.com.au/nation ... a1b72eaa92

And some factual accurate assessments of Labor's stupidity.

Kenneth 4 DAYS AGO

I don’t understand this furore over trusts. Profits flow through trusts and must be distributed every year to the beneficiaries who then pay tax on these earnings with minors having a very low $400 odd limit for tax free distribution over that the top marginal rate was applied. So all this rot that people go on about the tax savings are complete LIES

We don’t have a family trust but I can see why small business uses it to keep hold of their cash to counter the ebb and flows of business, if you make them pay themselves PAYG many won’t have the cash flow to function.

Simon 5 DAYS AGO

Superb analysis - the only way Labor can implement its lofty promises is to penalise taxpayers - we will all be worser off under Labor!

Pat 5 DAYS AGO

So small businesses, their trusts, their SMFS, and pensioners reviving franked dividends are to be taxed at 30%, while the franked dividends received by the industry funds - into which this kleptocratic cabal of unionists, political puppets, and apparatchiks - pour the huge amounts of super deducted from their inflated salaries, will be taxed at zero%, not 30% ?

Paul 5 DAYS AGO

Trusts just aren't what they were, already.

The swag of changes announced by Labor add up to a considerable impost on small businesses.

The belief that the owners will likely pay more tax while seemingly accurate ignores the actuality of where those taxes will come from.

Removing up to $20B a year from the economy will have consequences, many of which remain unknown.

People impacted will reduce investment. They will also seek labour cost savings, likely the ultimate sacrifice for the tax imposts. I may end up paying more tax but the ultimate source of that money will be someone or something else.

- brian ross

- Posts: 6059

- Joined: Thu Apr 19, 2018 6:26 pm

Re: Voters now frightened of mad crazy Labor

Oh, dearie, dearie, me. I have never been a member of GetUp! Nor have I ever frequented their website. Your insults are simply empty words. Stop acting like a six year old and stop posting Tory propaganda. You lot are going to lose the next federal election. Even The Spectator believes it: Why the Liberal Party is bound for the exit. Time you caught up with reality and actually debated the facts, not just bullshit, mate.

Nationalism is not to be confused with patriotism. - Eric Blair

-

Patriot

- Posts: 127

- Joined: Tue Aug 14, 2018 7:22 am

Re: Voters now frightened of mad crazy Labor

Libs main job is to put the fear of Shorten into the voters leading up to the election so voters will wince and shudder every time they hear that awful name.

Labor’s Tax Grab Will Hurt Our Economy

When voters go to the ballot box this year, they will face a clear choice. It will be between a government that has delivered lower taxes, lower spending and more than 1.2 million new jobs and a Labor Party that has promised $200 billion in new taxes to fund reckless spending promises.

While much of the focus has been on changes to negative gearing and franking credits, Labor's plan to increase capital gains tax by 50 per cent has gone largely under the radar. This is despite the fact Labor's CGT changes will raise more than $12bn, around two-thirds of what Labor is expecting to raise from its changes to negative gearing.

Again, Labor is walking away from more than two decades of bipartisan tax policy, with the current CGT arrangements introduced by the Howard government in 1999 with Labor's support. Until then, capital gains tax was levied on the asset cost base after deductions for inflation. In the parliamentary debate at the time, Labor members were enthusiastically in support of the Coalition's CGT changes, with current frontbencher Joel Fitzgibbon saying, “I give a tick to the measures of the 50 per cent reduction in CGT. I have no argument with that,” and Labor senator Joe Ludwig saying, “This should improve our overall international competitiveness.”

Now, however, in a desperate grab for revenue, Labor's attitude has changed. If Labor is successful in legislating a 50 per cent increase, it will see Australians subject to a capital gains tax rate that is higher than any comparable country. This includes the US, Britain, Canada, New Zealand, Japan, Germany, France, Ireland and South Africa.

The consequential and damaging impact on the economy from the CGT increase will be significant. The independent Centre for International Economics has estimated that the capital gains tax hike will lower GDP by $3.7bn a year; reduce real wages by 0.7 per cent, equivalent to about $600 a year for someone on average full-time earnings; reduce construction activity by more than 3000 dwellings a year, leading to higher rents; and damage state balance sheets with reduced GST distribution and property tax collections by about $1bn a year. This would put state governments, in the words of the CIE, under “severe pressure”.

The overall contraction in the economy that follows Labor's CGT changes also will have a negative impact on the federal government's coffers. The CIE report says that while CGT receipts may increase, there will be a fall of more than $2bn in other tax receipts as the economy slows. The net revenue increase therefore from the C GT changes may be less than $500m, a fraction of what Labor is counting on. This creates the invidious but not unprecedented scenario for Labor (think mining tax) where it commits to new spending on the assumption of a tax revenue windfall that never eventuates.

Initially, Labor framed its justification for a capital gains tax increase around the issue of rising housing prices. However, three years later, the housing market is very different. Prices in capital cities have been falling, not rising.

Labor's initial justification no longer holds, yet it sticks to its policy. This is because, philosophically, Labor has abandoned the aspirational class. The would-be investor, who through their thriftiness and personal responsibility, saves for their own retirement is now a target for Labor.

It was Paul Keating who not long ago said of Bill Shorten's Labor Party that “it has lost the ability to speak aspirationally to people and to fashion policies to meet those aspirations”.

Shorten believes it is only “the very wealthy” who are trying to “turn their income into capital”. But the reality is different. Tax data shows that in the 2015-16 year, nearly 900,000 individuals had a capital gain on their tax return. These are not necessarily high-income individuals. Just as the tax data on negative gearing showed two-thirds of the people using this concession had a taxable income of under $80,000 a year, so too with the capital gains tax discount there will be many teachers, nurses and emergency services personnel who are making modest investments to build their nest egg.

You have to look no further than Labor's national conference for evidence that the modern Labor Party is all about redistributing the pie and not growing it. Labor's focus is solely on the equality of outcomes in contrast to the Coalition, which is focused on equality of opportunity.

You have to wonder about the motivations of a shadow treasurer and Labor Party that believes a 50 per cent tax increase is an example of “perfectly designed and calibrated policy”. It reveals their unashamed determination to increase taxes regardless of the adverse effect it will have on investment, jobs and the economy.

Wealth creation for Labor is a dirty word, despite it being the means by which all Australians aspire to a better life. This is what the Coalition believes in and this will be at the heart of the contest at the next election.

Labor’s Tax Grab Will Hurt Our Economy

When voters go to the ballot box this year, they will face a clear choice. It will be between a government that has delivered lower taxes, lower spending and more than 1.2 million new jobs and a Labor Party that has promised $200 billion in new taxes to fund reckless spending promises.

While much of the focus has been on changes to negative gearing and franking credits, Labor's plan to increase capital gains tax by 50 per cent has gone largely under the radar. This is despite the fact Labor's CGT changes will raise more than $12bn, around two-thirds of what Labor is expecting to raise from its changes to negative gearing.

Again, Labor is walking away from more than two decades of bipartisan tax policy, with the current CGT arrangements introduced by the Howard government in 1999 with Labor's support. Until then, capital gains tax was levied on the asset cost base after deductions for inflation. In the parliamentary debate at the time, Labor members were enthusiastically in support of the Coalition's CGT changes, with current frontbencher Joel Fitzgibbon saying, “I give a tick to the measures of the 50 per cent reduction in CGT. I have no argument with that,” and Labor senator Joe Ludwig saying, “This should improve our overall international competitiveness.”

Now, however, in a desperate grab for revenue, Labor's attitude has changed. If Labor is successful in legislating a 50 per cent increase, it will see Australians subject to a capital gains tax rate that is higher than any comparable country. This includes the US, Britain, Canada, New Zealand, Japan, Germany, France, Ireland and South Africa.

The consequential and damaging impact on the economy from the CGT increase will be significant. The independent Centre for International Economics has estimated that the capital gains tax hike will lower GDP by $3.7bn a year; reduce real wages by 0.7 per cent, equivalent to about $600 a year for someone on average full-time earnings; reduce construction activity by more than 3000 dwellings a year, leading to higher rents; and damage state balance sheets with reduced GST distribution and property tax collections by about $1bn a year. This would put state governments, in the words of the CIE, under “severe pressure”.

The overall contraction in the economy that follows Labor's CGT changes also will have a negative impact on the federal government's coffers. The CIE report says that while CGT receipts may increase, there will be a fall of more than $2bn in other tax receipts as the economy slows. The net revenue increase therefore from the C GT changes may be less than $500m, a fraction of what Labor is counting on. This creates the invidious but not unprecedented scenario for Labor (think mining tax) where it commits to new spending on the assumption of a tax revenue windfall that never eventuates.

Initially, Labor framed its justification for a capital gains tax increase around the issue of rising housing prices. However, three years later, the housing market is very different. Prices in capital cities have been falling, not rising.

Labor's initial justification no longer holds, yet it sticks to its policy. This is because, philosophically, Labor has abandoned the aspirational class. The would-be investor, who through their thriftiness and personal responsibility, saves for their own retirement is now a target for Labor.

It was Paul Keating who not long ago said of Bill Shorten's Labor Party that “it has lost the ability to speak aspirationally to people and to fashion policies to meet those aspirations”.

Shorten believes it is only “the very wealthy” who are trying to “turn their income into capital”. But the reality is different. Tax data shows that in the 2015-16 year, nearly 900,000 individuals had a capital gain on their tax return. These are not necessarily high-income individuals. Just as the tax data on negative gearing showed two-thirds of the people using this concession had a taxable income of under $80,000 a year, so too with the capital gains tax discount there will be many teachers, nurses and emergency services personnel who are making modest investments to build their nest egg.

You have to look no further than Labor's national conference for evidence that the modern Labor Party is all about redistributing the pie and not growing it. Labor's focus is solely on the equality of outcomes in contrast to the Coalition, which is focused on equality of opportunity.

You have to wonder about the motivations of a shadow treasurer and Labor Party that believes a 50 per cent tax increase is an example of “perfectly designed and calibrated policy”. It reveals their unashamed determination to increase taxes regardless of the adverse effect it will have on investment, jobs and the economy.

Wealth creation for Labor is a dirty word, despite it being the means by which all Australians aspire to a better life. This is what the Coalition believes in and this will be at the heart of the contest at the next election.

-

Patriot

- Posts: 127

- Joined: Tue Aug 14, 2018 7:22 am

Re: Voters now frightened of mad crazy Labor

It is important to share the gloom and doom that will permanently blanket the Shorten shemozzle with the voters to scare the legs off them before the election.

Labor’s High-Tax Policies Would Be Aspiration Killers

Many Australians remain in holiday mode. But post-Christmas credit card bills, the return to work and tumbling property values in Sydney and Melbourne are prompting many people to take stock. In doing so, four months from the federal election, it makes eminent sense to compare the key economic policies of the Coalition and Labor and how they would pinch the hip pockets of households and businesses for years or even decades to come. As the nation faces the likelihood of a change of government, Bill Shorten and his Treasury spokesman, Chris Bowen, to their credit, have not shied away from setting out a detailed economic narrative.

Under the guise of “fairness” they have stuck with it, regardless of criticisms from those who would lose heavily as Labor shifted the nation towards higher taxes, bigger government and a more omnipotent welfare state.

For the past week, this newspaper has cut through the argy-bargy, putting the blowtorch to key issues in play and how they will affect voters’ hip-pocket nerves, such as capital gains and personal taxes, negative gearing, welfare changes, superannuation and workplace relations. After crunching the numbers and considering the arguments of Josh Frydenberg and Mr Bowen, it is clear that voters who aspire to greater prosperity owe it to themselves and to their families to assess the cost benefits of the parties’ contrasting policies.

A week ago, The Weekend Australian examined Labor’s plan to hike capital gains tax. It would see Australians taxed up to 36.75 per cent on capital gains, compared with 23.5 per cent now. While 885,530 taxpayers declared capital gains in 2015-16, mainly from shares and investment property sales, the cost of the opposition’s pledge largely has slipped under the radar, unlike its promised crackdown on negative gearing. In supporting Labor, voters would be supporting the highest CGT rate in the Anglosphere. US investors pay 23.8 per cent tax on capital gains, the British 28 per cent on residential property and 20 per cent on other assets, and Canadians 16.5 per cent. According to home builder Tamawood, which has slashed its profit expectations by 26.9 per cent, Labor’s changes would help create a “perfect storm” in depressed real estate markets. Mr Bowen was notably unapologetic, noting that 70 per cent of the current CGT discount advantages the top 10 per cent of income earners.

Quasi class warfare also pervades Labor’s income tax policy, under which more than a million Australians, double the current number, would find themselves paying a top marginal rate of 49 per cent within six years, Treasury figures show. Labor’s top rate, one of the highest in the world, would cut in at 2.2 times average full-time earnings, compared with eight times average full-time earnings in the US.

Not everyone would lose under a Shorten government, however. After 20 years of welfare reform guided by the sound principles of Bob Hawke’s “reciprocal obligation” and John Howard’s “mutual obligation” policies, Labor has announced a softer approach to jobseekers, including redesigning work for the dole and ditching the need for the unemployed to apply for 20 jobs a month. The Business Council of Australia wants the system overhauled, arguing employers are bearing the costs of sorting through unsuitable job applications. Further reform is needed, mainly because welfare continues to account for more than a third of federal spending. It would be disastrous, as Noel Pearson warns, if Labor caused a backslide towards the passive welfare dependence that hard-won reforms of the past 25 years helped overcome.

As the population ages, the retirement policies of both major parties demand close scrutiny if workers’ superannuation returns are to be maximised and reliance on the Age Pension reduced. Both major parties have mixed records on super. But as reported today, Treasury estimates show Labor’s proposed changes could leave up to a million workers worse off through tax changes and abolition of the government’s measure to allow concessional catch-up contributions. The opposition, dominated by the union movement, which controls lucrative industry-based funds, has blatantly rejected the Productivity Commission’s main recommendation for improving retirement savings.

Superannuation is just one area in which the unions would dominate a Shorten government. Labor has pledged rigid regulation of workplaces and agreed to allow unions to make wage claims on multiple employers. That move, Australian Industry Group chief executive Innes Willox warns, has “left the door open to rampant industrial disputation across the entire Australian economy”. Next week’s strike at a Wollongong colliery over labour-hire workers is a foretaste of what could be expected.

While exasperated by much of the drivel that passes for political debate and by the Coalition’s internecine warfare, voters, in their own interests, should scrutinise the costs of the parties’ policies. If Coalition MPs are to lift their dismal act they should recall how the mantra “It’s the economy, stupid” propelled Bill Clinton to power in 1992.

As the government achieves the first surplus since Mr Howard lost office, it has the ammunition to take Labor apart, point by point, tax by tax, dead-handed policy by policy, and highlight the dangers of stumbling blindly down a socialist dead end. Unless more ministers plunge in and fight on their ground — growth and jobs — they and Australians aspiring to be justly rewarded for hard work are on a hiding to nothing.

Labor’s High-Tax Policies Would Be Aspiration Killers

Many Australians remain in holiday mode. But post-Christmas credit card bills, the return to work and tumbling property values in Sydney and Melbourne are prompting many people to take stock. In doing so, four months from the federal election, it makes eminent sense to compare the key economic policies of the Coalition and Labor and how they would pinch the hip pockets of households and businesses for years or even decades to come. As the nation faces the likelihood of a change of government, Bill Shorten and his Treasury spokesman, Chris Bowen, to their credit, have not shied away from setting out a detailed economic narrative.

Under the guise of “fairness” they have stuck with it, regardless of criticisms from those who would lose heavily as Labor shifted the nation towards higher taxes, bigger government and a more omnipotent welfare state.

For the past week, this newspaper has cut through the argy-bargy, putting the blowtorch to key issues in play and how they will affect voters’ hip-pocket nerves, such as capital gains and personal taxes, negative gearing, welfare changes, superannuation and workplace relations. After crunching the numbers and considering the arguments of Josh Frydenberg and Mr Bowen, it is clear that voters who aspire to greater prosperity owe it to themselves and to their families to assess the cost benefits of the parties’ contrasting policies.

A week ago, The Weekend Australian examined Labor’s plan to hike capital gains tax. It would see Australians taxed up to 36.75 per cent on capital gains, compared with 23.5 per cent now. While 885,530 taxpayers declared capital gains in 2015-16, mainly from shares and investment property sales, the cost of the opposition’s pledge largely has slipped under the radar, unlike its promised crackdown on negative gearing. In supporting Labor, voters would be supporting the highest CGT rate in the Anglosphere. US investors pay 23.8 per cent tax on capital gains, the British 28 per cent on residential property and 20 per cent on other assets, and Canadians 16.5 per cent. According to home builder Tamawood, which has slashed its profit expectations by 26.9 per cent, Labor’s changes would help create a “perfect storm” in depressed real estate markets. Mr Bowen was notably unapologetic, noting that 70 per cent of the current CGT discount advantages the top 10 per cent of income earners.

Quasi class warfare also pervades Labor’s income tax policy, under which more than a million Australians, double the current number, would find themselves paying a top marginal rate of 49 per cent within six years, Treasury figures show. Labor’s top rate, one of the highest in the world, would cut in at 2.2 times average full-time earnings, compared with eight times average full-time earnings in the US.

Not everyone would lose under a Shorten government, however. After 20 years of welfare reform guided by the sound principles of Bob Hawke’s “reciprocal obligation” and John Howard’s “mutual obligation” policies, Labor has announced a softer approach to jobseekers, including redesigning work for the dole and ditching the need for the unemployed to apply for 20 jobs a month. The Business Council of Australia wants the system overhauled, arguing employers are bearing the costs of sorting through unsuitable job applications. Further reform is needed, mainly because welfare continues to account for more than a third of federal spending. It would be disastrous, as Noel Pearson warns, if Labor caused a backslide towards the passive welfare dependence that hard-won reforms of the past 25 years helped overcome.

As the population ages, the retirement policies of both major parties demand close scrutiny if workers’ superannuation returns are to be maximised and reliance on the Age Pension reduced. Both major parties have mixed records on super. But as reported today, Treasury estimates show Labor’s proposed changes could leave up to a million workers worse off through tax changes and abolition of the government’s measure to allow concessional catch-up contributions. The opposition, dominated by the union movement, which controls lucrative industry-based funds, has blatantly rejected the Productivity Commission’s main recommendation for improving retirement savings.

Superannuation is just one area in which the unions would dominate a Shorten government. Labor has pledged rigid regulation of workplaces and agreed to allow unions to make wage claims on multiple employers. That move, Australian Industry Group chief executive Innes Willox warns, has “left the door open to rampant industrial disputation across the entire Australian economy”. Next week’s strike at a Wollongong colliery over labour-hire workers is a foretaste of what could be expected.

While exasperated by much of the drivel that passes for political debate and by the Coalition’s internecine warfare, voters, in their own interests, should scrutinise the costs of the parties’ policies. If Coalition MPs are to lift their dismal act they should recall how the mantra “It’s the economy, stupid” propelled Bill Clinton to power in 1992.

As the government achieves the first surplus since Mr Howard lost office, it has the ammunition to take Labor apart, point by point, tax by tax, dead-handed policy by policy, and highlight the dangers of stumbling blindly down a socialist dead end. Unless more ministers plunge in and fight on their ground — growth and jobs — they and Australians aspiring to be justly rewarded for hard work are on a hiding to nothing.

Who is online

Users browsing this forum: No registered users and 10 guests