Now what the Greeny Types HATE - FACTS because it destroys their delusional fantasies.

Shoddy quality control and using drivers as test guinea pigs to find the many faults in their TESLA cars will result in the HUGE auto manufacturers like Mercedes and Volkswagen etc wiping the floor with TESLA.

Another head on TESLA crash

The Weird Mistakes Killing Tesla or the Decline and Fall of TESLA

By Rob Enderle Aug 13, 2018 11:06 AM PT

tesla may be failing due to self-inflicted wounds rather than competition

tesla may be failing due to self-inflicted wounds rather than competition

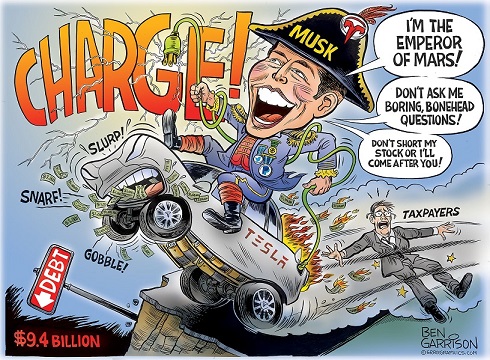

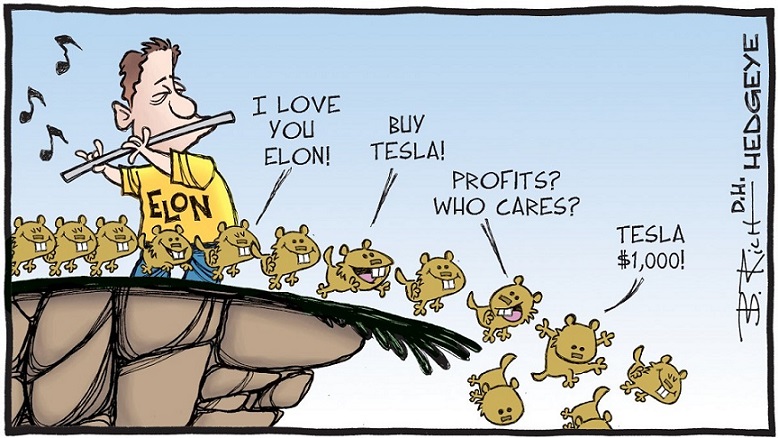

Tesla is trending to fail spectacularly. (CEO Elon Musk actually has an impressive failure history.) Tesla has been burning cash at an unsustainable rate, and it keeps making avoidable mistakes that weaken it.

Here's what is weird: You'd think the firm's biggest problem would be that every large car maker was working behind the scenes to kill it. However, with the exception of the dealerships (which I'll get to), the car companies for the most part appear to have worked harder to emulate Tesla than to destroy it.

I expect that if Tesla fails, all fingers will point to Musk and the executive team as problems because we focus more on blame than understanding the cause of a mistake. This is problematic, because folks then don't learn from mistakes -- they just learn to dodge blame and avoid risks, which would be the wrong lesson to take away from this.

In short, Tesla's biggest problem is itself.

Tesla vs. Top Gear

Top Gear used to be one of the most popular automotive shows in the world until one of its hosts slugged a producer for not having the right food and the entire cast left.

Every week the show hosts pretty much abused themselves, and a bunch of cars, for our humorous enjoyment. It was the most popular car show in the world. The hosts were not race car drivers, mechanics, or automotive engineers. They were basically comedians using cars as a vehicle to entertain a lot of people.

They liked some cars (Jaguars, Porsche, etc.) and were generally down on American iron and one or two European brands. When they tested the Tesla sports car they didn't like it. I can't blame them, because when I tested the Tesla sports car I didn't like it either.

Based on a Lotus, which isn't known for reliability but is known to be one of the best track cars on the planet, it was kind of a rattling mess that sucked on a road track but would kick butt 0-60.

They didn't like the car, so Tesla -- instead of taking their opinion in stride -- sued the show. The company lost (apparently its similar fight with The New York Times played a role), but the litigation focused people on the review that damaged Tesla's image, not only as a car company but as a rebel brand. Rebels don't sue comedians.

Tesla Quality

One of the big advantages Tesla had was in approaching the market with nearly a clean slate. However, in manufacturing, decades have gone into creating processes that result in high-quality cars. What a lot of us thought Tesla did was just get rid of the processes that made no sense in their ramp-up to manufacture cars, but what it appears to have done is start everything from scratch. That resulted in relatively low quality for the initial runs of every car Tesla made.

You'd think that by the time the Model 3 was released, this issue would have been sorted, but quality issues surrounding the Model 3 seem to be in line with, if not worse than, those that plagued the Model S initially.

Adapting quality controls and accountability in line with Toyota should have been a goal for the firm, but apparently it was not. There is no price point where adequate quality is optional. In addition, because problems related to fit and finish, consistency in materials, and panel gaps had to be corrected in the field under warranty, Tesla's ability to generate a profit was significantly compromised. Quality should have been job one. Instead, it constantly appeared to be an afterthought. For a luxury brand, being ranked toward the bottom on quality is never good.

Tesla X

While the Tesla S and Model 3 are really good cars in their respective segments (initial quality aside), the Model X made almost no sense whatsoever. (Consumer Reports called it "Fast and Flawed.") The easy path to creating a good SUV is to start with something like a Land Rover in terms of design target and then refine it to make the result uniquely yours.

The Jaguar F-Pace is a good example, in that it borrows from the Range Rover with features but has more of a performance/design focus allowing it to stand out against its Range Rover peer. Granted, it helps that Tata Motors owns both Jaguar and Range Rover.

SUVs basically are more masculine minivans, which means they need to be very reliable, they need to be as effective as trucks (carrying both people and materials), and they need offroad skills (that folks mostly won't use but do consider when buying).

Instead, what Tesla appeared to create was a pregnant Model S. Initially, the back seats didn't even fold down, so you couldn't use it to carry materials. It had gull wing doors that had a very high failure rate (way too complex), a windshield that was wicked expensive to replace -- but so big that getting hit by a rock was a given -- and no offroad chops at all. In short, it was an SUV that sucked at being an SUV. How do you miss THAT meeting?

The Autopilot Fiasco

When I was growing up, a story about cruise control made the rounds. One version went like this: A guy came to the U.S. and wanted to tour the country on the road. He rented an RV, and when getting a briefing about the features, asked about the cruise control. The sales guy told him it was kind of like a plane's autopilot. So, the guy went out on the road, set the cruise control, and went back to make some coffee. It ended really badly for the driver, the RV and the rental company.

The industry lesson, whether these incidents actually took place or not, was "don't call cruise control 'autopilot,'" because people will do stupid things.

So, what does Tesla call its adaptive cruise control? "Autopilot." The feature has been implicated in some fatalities, and Consumer Reports even asked Tesla to change the name. Tesla refused. One wonders whether Tesla would rather have dead customers then have to change a foolish name.

Dealer Issues

In the U.S. dealers move cars. On much of the East Coast, the folks who own dealerships are politicians. Tesla rolled to market with a company store model that was at least as problematic as coming to market with an electric car.

It meant Tesla had to set up and fund the entire sales channel as opposed to recruiting dealers that largely would self-fund the effort. The politicians who owned dealerships moved against Tesla and were able to pass laws barring Tesla stores in some states. Granted much of this activity was anticompetitive and should have been illegal, but it still created a huge drag on sales and expansion, which a new car company doesn't need.

Oh, and the stores, based on recent reports, perform very poorly compared to the traditional dealerships with regard to selling cars.

Solar City

Solar City, another Elon Musk company, recently was in danger of going under. To save the firm, Tesla bought it. Tesla, which has been unprofitable, increased its risk of failure by absorbing another unprofitable company. Two unprofitable companies, when added together, don't make a profitable company.

For the most part, the deal put more pressure on Tesla's income statement, further reduced its reserves, increased the firm's complexity, and made it less likely to survive. Now there should be a reasonably high synergy between solar power and electric cars, but that synergy has not emerged yet at Tesla. (Also, Solar City has been having execution problems of its own.)

Going Private

Going private isn't a bad idea. It worked really well for Dell. However, Dell was profitable, and assets exceeded liabilities, which means there was such a thing as stockholder equity.

However, Tesla's liabilities exceed assets by billions, which means there isn't such a thing as stockholder equity. So how do you fund the effort? More importantly, bringing up the possibility -- which did spike the stock and really screw with short sellers -- has triggered scrutiny of Tesla's financials and caused a lot of mini-heart attacks based on what people saw. It also may have triggered an SEC investigation, and those seldom end well.

Both things could scare customers away from Tesla at a time when they are desperately needed to get the company into the black before the cash reserves run out.

Self-Driving Capability

Tesla recently announced that it was developing its own autonomous car processor and planned to displace its primary vendor of this technology, Nvidia. As noted, Tesla currently is short on operating funds and it recently has begun to beg suppliers for kickbacks in order to save the company.

To create Nvidia's current autonomous car platform (which is 10x the speed of the one Tesla currently uses) took five years and around US$2B (or about what Tesla now has in short term assets).

They has neither the time nor the money, and this is an area in which it can't scrimp on quality. At a time when the firm should be husbanding its cash and focused like a laser on getting the company profitable, why start an expensive development process to reinvent a very expensive component?

In addition, it faces a bigger problem: charging infrastructure, particularly in city centers. Currently folks have mixed opinions on autonomous driving, but all seem to agree that the fear of not being able to charge an electric vehicle is one of the biggest concerns limiting sales.

Wrapping Up

Given its size and influence, Tesla's failure would be catastrophic for a number of reasons. It likely would slow significantly the development of electric cars, which are needed to combat global warming (watching California burn this month has certainly driven that need home).

It likely would begin a cascade of failures across Musk's other companies, like SpaceX, which could find it difficult to raise necessary operating funds.

It could cause a sudden change in the stock market, influencing it to become excessively conservative, resulting in a massive broad market correction. It could significantly set back innovation in the U.S automotive industry, accelerating a shift to China as the next big automotive superpower.

The way to fix the company is to stop it from shooting itself in the foot. Get it to avoid unnecessary fights, focus it on profits, bring up quality, reduce distractions and crazy behavior, and operate like a real business, which means making some hard decisions about the names that are used and the sales channel that isn't working well. Tesla doesn't have a ton of time.

By the way, it struck me to look at Tesla's board of directors. Ironically, there is not a single car, manufacturing, sales, or transportation expert on it. I think I've just found the core of Tesla' problems.

https://www.technewsworld.com/story/85498.html