Voters are filled with trepidation as they are made aware of the devastation of Australia which would be caused by Labor's unfunded extremely expensive ridiculous Socialist stupidity and the huge tax increases and insane out of control borrowing which would try to fund these absurdities.

There is a dark cloud on Bill Shorten's Labor horizon and it is ScoMo the Shorty killer.

‘Radical, aggressive and dangerous’: Treasurer warns of Labor’s spending agenda

Samantha Maiden 10:31pm, Jan 21, 2019

Treasurer Josh Frydenberg will argue Labor's policies will set back the country for decades. Photo: Getty

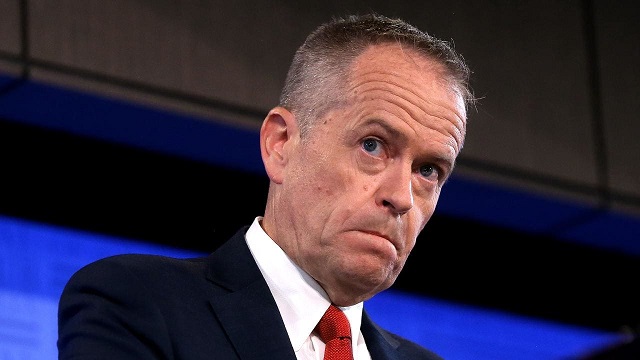

Bill Shorten’s tax and spend platform represents the most “radical, aggressive and dangerous” tax agenda Australia has ever seen, Treasurer Josh Frydenberg will warn in a major speech on Tuesday.

Speaking at the Sydney Institute, the Treasurer will argue that Labor’s unashamed embrace of higher taxes for business will set the country back decades.

Predicting that a Shorten government will be more anti-business than the Hawke-Keating government and the Rudd-Gillard years, Mr Frydenberg will outline the government’s election pitch on the economy.

“What is absolutely certain is that as a nation we cannot afford to fall for the false prophets who would have you believe that a country can tax itself into prosperity, that a government can redistribute what its economy doesn’t produce, and that growth can be achieved while punishing aspiration,” Mr Frydenberg says.

“For Labor, the pursuit of class warfare is more than rhetoric. It is at the heart of their policies from tax to trade to industrial relations. It’s a dark shadow not a light on the hill.

“Labor has ignored the message from the Productivity Commission that our tax and transfer system has been successful in reducing income inequality and that the one constant that matters most in tackling inequality and poverty is having a job.

“Instead, Labor is promising one of the most radical, aggressive and dangerous tax and redistribution agendas Australia has ever seen. Putting at risk our prosperity and harmony and taking us back decades.

“No wonder there is now such a loud and growing chorus of opposition. Australians are starting to see Bill Shorten’s plan for what it really is.”

The Morrison government has spent the summer ramping up its attacks on Labor’s negative gearing policies, a strategy that proved fruitless during the 2016 election.

However, the Treasurer insists the campaign is starting to gain traction.

Foreshadowing the speech, Labor’s treasury spokesman Chris Bowen predicted it would just prove more of the same.

“Josh Frydenberg is giving a speech on the economy tomorrow. It’s his chance to outline his vision for the economy and announce policies to deal with low productivity growth, high household debt and anaemic real wages growth. But I reckon it will more likely say ‘Labor, Labor, Labor’,” Mr Bowen said.

The speech, titled Creating opportunity and encouraging aspiration: The key to a growing economy and a stronger Australia, argues only the Coalition will continue to fight for economic reform.

On trade, Mr Frydenberg argues Labor pandered to union interests when debating the free trade agreement with China.

“It is no secret that our political opponents equivocated on the China FTA, gave up on the TPP, saying it was ‘dead in the water’ and are now threatening to open up settled agreements at the behest of the unions,” he says.

Mr Frydenberg also predicts there are “storm clouds hanging over the global economy”.

“Persistent trade tensions, high global debt levels and a contraction in growth in several key economies has changed the global outlook,” he says.

“Domestically, the drought is having an impact, the housing market has softened, there are signs that credit growth has been constrained and the pick up in wages growth remains gradual.”

In the speech, Mr Frydenberg also makes the case for “Liberal values” on the economy, arguing greater personal responsibility is the key and warning governments cannot fix every problem.

https://thenewdaily.com.au/news/nationa ... ng-agenda/