The Libs can win the SA election just by concentrating on the very high cost of electricity which is a result of the Secondary Power renewable rubbish which means the electricity is generated TWICE once by the unreliable unstable Secondary Power renewable rubbish and once by the reliable super stable Primary Power Coal generators.

South Australia pays the price of big system peaks

By Giles Parkinson on 12 March 2018

South Australia is once again being assailed for having the most expensive wholesale electricity prices in the country – and new data underlines why it is the state most vulnerable to extraordinary jumps in prices at times of high peaks and interrupted supply.

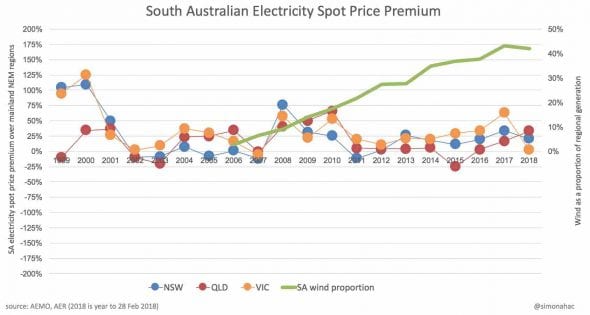

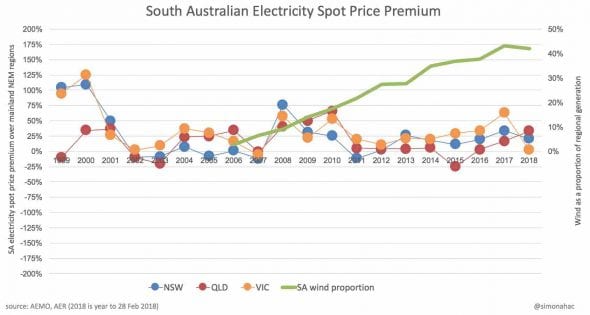

Last week, we published this graph (above) to show how South Australia’s price premium over other states has existed for the best part of two decades – courtesy of its small grid at the end of the line, the control of a few big players, and its “peaky grid”, exacerbated by its mild climate and the occasional heatwave.

The problems over South Australia’s “peaky grid” were identified more than a decade ago by the local grid owner (well before the emergence of renewables) which noted its exposure to sharp rises in prices, particularly in the midst of heatwaves.

This summer has been no exception. From December 1 to February 28, the total cost of wholesale electricity (market turnover) in the South Australia market was $929 million, according to data put together by Dylan McConnell of the Climate and Energy College in Melbourne.

Of this sum, around 34% was attributable to price spikes above $300 – the standard cap contract strike price – that occurred in just 42 half-hour trading intervals. That’s a total of 21 hours and represents just 0.97 per cent of time.

Such events were typified by January 18, when a heatwave was likely to push prices higher as more customers turned to air conditioning.

But prices soared following the trip of the big Loy Yang B coal generator in Victoria – an event that sent prices near to their market peak in both Victoria and South Australia.

This is not atypical. Peaking gas plants and diesel generators typically operate for just a few hours of the day – and need to recoup as much as they can in those periods. Hence the high prices. But it is wrong to put the finger on renewables, as the first graph above explains.

One of the fundamental problems of the design of the NEM is that both generation and network design have delivered enormous gains for assets that are just used for a few hours of the year.

Yet, at the same time, regulators have consistently rejected proposals that could ease that peak demand – energy efficiency, demand response, storage incentives – under pressure from incumbent interests wanting to defend the gold plating of prices.

It explains the government’s eagerness to encourage new forms of storage – including the Tesla big battery, which is already slashing peak prices from the small and little known FCAS market, pumped hydro and solar thermal.

The data from McConnell showed that in South Australia over summer:

In the 42 trading intervals that the price was above $300, the volume weighted price was $3,171.42/MWh

For the remainder of summer (i.e. intervals below $300) the volume weighted prices was $93.50/MWh

The average over the whole summer was $146.15/MWh (i.e. those 42 hours added about $50/MWh to volume weighted prices over summer)

On that last point, it is interesting to note that in December, when there were no major pricing peaks above $300/MWh, South Australia’s wholesale electricity prices were lower than both Victoria and Tasmania.

The peak pricing events in South Australia over January and February happened on six different days – Jan 18 and 19, Jan 25, Jan 28, Feb 7 and Feb 8.

http://reneweconomy.com.au/south-austra ... aks-85072/