Australian Federal, State and Local Politics

Forum rules

Don't poop in these threads. This isn't Europe, okay? There are rules here!

-

Rorschach

- Posts: 14801

- Joined: Wed Jun 06, 2012 5:25 pm

Post

by Rorschach » Thu Oct 27, 2016 9:18 am

Interesting but pathetic that Morrison says supply and demand is the answer to the price of Housing in Australia.

I'm betting that even if more land is made available for Housing, the prices will not drop.

http://www.smh.com.au/comment/whos-to-b ... samj2.html

Who's to blame for rising house prices? We are, actually

Peter Martin

If only we had a clue why home prices are soaring out of reach. On Monday Treasurer Scott Morrison offered half a clue. He told the Urban Development Institute it was all about supply. The more houses and apartments that developers were allowed to build, he said, the more residents would be able to buy.

That's true, if you avert your eyes from some of the more immediate reasons residents are unable to buy. And they're growing.

Morrison said over the past 20 years the proportion of households either owning outright the homes in which they live or buying them with a mortgage has slid from 71 to 67 per cent. For Australians aged 25 to 34 the proportion has dived from 39 to 29 per cent, and for those between 35 and 44, from 63 to 52 per cent. These days only 13 per cent of new home loans go to first home buyers, down from 19 per cent.

So expensive are homes becoming that the share of median household income devoted to mortgage payments for Australians aged 35 to 44 has more than doubled in 30 years. Incredibly, it's happened at a time when mortgage rates have slid to their lowest on record.

Morrison says more houses and units will solve the problem, but at the rate at which they are being snapped up by investors (more than half the money lent to buy homes each month now goes to investors, up from 15 per cent during the 1990s) they won't help much.

As one of Morrison's colleagues, Liberal backbencher John Alexander, puts it: "It's not much good increasing supply if it's consumed by opportunistic investors."

What matters for a tolerable retirement (far more than superannuation) is owning the home in which you live. If you do, the age pension is enough to get by on. If you don't, you have to pay rent. Morrison's own figures show we are condemning more and more Australians to retirements burdened by rent.

Alexander conducted the inquiry into home ownership that the government seems to have sat on. Thirty hours of expert testimony and scores of submissions have produced nothing, so far. Work more or less stopped when Alexander was moved to another committee this time last year and then the inquiry was allowed to "lapse" after the election.

But looking through the hundreds of pages of transcripts it's possible to get a good idea of why home ownership is shrinking, and the best place to start is the evidence from Morrison's department, treasury, then run by Joe Hockey.

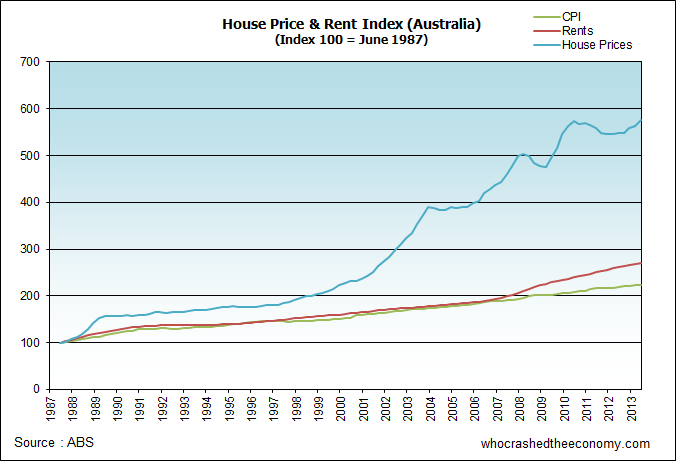

Graph 13 in its submission shows that up until the end of the 1990s the median dwelling price stayed in a tight band of 2.5 to 3 times household after-tax income. Then in the space of three years it shot up to near four times after-tax income and has stayed there ever since.

What happened at the end of the 1990s? In September 1999 the government halved the headline rate of capital gains tax, making negative gearing suddenly an essential tax strategy. Whereas before, renting out a house at a loss for tax purposes had been mainly an exercise in delaying tax, because the eventual profit made selling the property would be taxed at close to the seller's marginal rate; afterwards, with the profit taxed at only half the marginal rate, it became an exercise in cutting tax.

One of the barely stated reasons why house prices have been climbing out of reach of new buyers is many of us have been becoming richer.

Would-be investors poured into the market. One in every six taxpayers became a landlord. To get there and stay there they've had to outbid would-be residents. As the Reserve Bank's Luci Ellis put it succinctly in evidence to the inquiry: "It is a truism that if an investor is buying a property, an owner-occupier is not."

Far from seeing the explosion in prices as a problem, the Howard government embraced it as a sign of success. "Rising house prices make for happy voters," one of his parliamentary secretaries, Ross Cameron, infamously declared. Howard said he had never heard of a voter complaining about rising prices.

The invasion of negative gearers has been followed by an invasion of foreign buyers, who push aside would-be owner-occupiers in exactly the same way. Rather than living in the homes they've bought, they treat them as investments and either leave them empty or rent them out to tenants who would have once had a chance of owning them.

The 2011 census found an extraordinary 12 per cent more dwellings than households, some of them not bought to live in, others bought as holiday homes and second homes.

One of the barely stated reasons why house prices have been climbing out of reach of first home buyers is many of us have been becoming richer, and we seem to want better located and more expensive, and second homes more than anything else.

Reinstating capital gains tax and imposing a land tax would help, as would building more houses. But there is something in our psychology that's doing it as well. We seem to want to push up the prices we complain about. Adding "supply" might do no more than give us something else to bid up.

Peter Martin is economics editor of The Age

DOLT - A person who is stupid and entirely tedious at the same time, like bwian. Oblivious to their own mental incapacity. On IGNORE - Warrior, mellie, Nom De Plume, FLEKTARD

-

Rorschach

- Posts: 14801

- Joined: Wed Jun 06, 2012 5:25 pm

Post

by Rorschach » Thu Oct 27, 2016 9:23 am

DOLT - A person who is stupid and entirely tedious at the same time, like bwian. Oblivious to their own mental incapacity. On IGNORE - Warrior, mellie, Nom De Plume, FLEKTARD

-

Rorschach

- Posts: 14801

- Joined: Wed Jun 06, 2012 5:25 pm

Post

by Rorschach » Thu Oct 27, 2016 9:24 am

DOLT - A person who is stupid and entirely tedious at the same time, like bwian. Oblivious to their own mental incapacity. On IGNORE - Warrior, mellie, Nom De Plume, FLEKTARD

-

IQS.RLOW

- Posts: 19345

- Joined: Mon Mar 08, 2010 10:15 pm

- Location: Quote Aussie: nigger

Post

by IQS.RLOW » Thu Oct 27, 2016 9:37 am

Peter Martin is an imbecile.

The simple economics of it is that supply is restricted while population is increasing due to immigration and the boom in house prices follows the immigration population curve. There has been no real increase in the supply side to counter the population increase.

Quote by Aussie: I was a long term dead beat, wife abusing, drunk, black Muslim, on the dole for decades prison escapee having been convicted of paedophilia

-

Rorschach

- Posts: 14801

- Joined: Wed Jun 06, 2012 5:25 pm

Post

by Rorschach » Thu Oct 27, 2016 6:46 pm

Funny Neferti very funny, so now we are doubling up on topics... yeah.

There are so many socks here it just aint funny eh.

DOLT - A person who is stupid and entirely tedious at the same time, like bwian. Oblivious to their own mental incapacity. On IGNORE - Warrior, mellie, Nom De Plume, FLEKTARD

-

Neferti

- Posts: 18113

- Joined: Wed Jan 12, 2011 3:26 pm

Post

by Neferti » Thu Oct 27, 2016 7:14 pm

Rorschach wrote:Funny Neferti very funny, so now we are doubling up on topics... yeah.

There are so many socks here it just aint funny eh.

Pardon? What did I do that got your balls in a twist?

-

Rorschach

- Posts: 14801

- Joined: Wed Jun 06, 2012 5:25 pm

Post

by Rorschach » Thu Oct 27, 2016 7:22 pm

Duplicate topic.... you know....

DOLT - A person who is stupid and entirely tedious at the same time, like bwian. Oblivious to their own mental incapacity. On IGNORE - Warrior, mellie, Nom De Plume, FLEKTARD

-

Neferti

- Posts: 18113

- Joined: Wed Jan 12, 2011 3:26 pm

Post

by Neferti » Fri Oct 28, 2016 8:05 am

Well, my topic was specifically about CANBERRA house prices and an entirely different article. All Homes is a Canberra based real estate organisation.

Did you want me to post it in YOUR thread?

http://www.allhomes.com.au/

http://www.allhomes.com.au/

-

Rorschach

- Posts: 14801

- Joined: Wed Jun 06, 2012 5:25 pm

Post

by Rorschach » Fri Oct 28, 2016 8:21 am

DOLT - A person who is stupid and entirely tedious at the same time, like bwian. Oblivious to their own mental incapacity. On IGNORE - Warrior, mellie, Nom De Plume, FLEKTARD

-

Rorschach

- Posts: 14801

- Joined: Wed Jun 06, 2012 5:25 pm

Post

by Rorschach » Fri Oct 28, 2016 8:53 am

Land release not the only answer to housing affordability crisis

The Australian

October 28, 2016

David Crowe

Political correspondent

It can take a long, long time for a federal politician to make an impact on Australia’s chronic problem with the price of housing.

John Howard is living proof. It is more than a decade since Howard and his colleagues vowed to increase the supply of housing, but only now are some of those homes coming on to the market.

This is a warning to Malcolm Turnbull and Scott Morrison as they raise expectations on housing affordability. This week has been a classic example of a government talking about a problem without coming up with a solution. Perhaps the solution is out there — but the Prime Minister and Treasurer should not be counting on any political dividend.

Howard’s pledge to voters was to release more land. In western Sydney, for instance, his government sold a former Defence Department munitions site near Penrith to allow about 5000 housing blocks, an idea that had been around since the 1970s.

It was a slow grind to overcome local objections to the development.

These days, part of the old explosives depot is called Jordan Springs, where a new home costs about $680,000. This buys a three-bedroom, two-bathroom brick-veneer home with a lock-up garage on a block of about 300sq m. This is one-third of the old quarter-acre block that past generations aspired to. And it costs more than 10 times the average household’s disposable income.

This is another sign of how younger Australians are losing out. Even if a family saved up a $100,000 deposit for life in Jordan Springs, they would have to scrape together mortgage repayments of about $1700 a fortnight.

This is simply out of reach for most. A full-time worker with an average income takes home about $2300 a fortnight after tax. Could they get by on $43 a day after the bank takes its due? Even with two incomes — before the kids arrive — the Australian dream can be a financial nightmare.

The evidence is clear: land supply is part of the affordability problem but can never be the answer on its own. Political ambitions of the past have not delivered enough.

More proof is on offer from other promises made a decade ago. After selling the Penrith site, the Howard government set out plans to sell 10 other properties that could take 10,000 new dwellings.

Some of those properties are still vacant today.

The Coalition planned to sell a former explosives site in the Melbourne suburb of Maribyrnong in 2010 but the remediation work is still under way. A former naval stores depot in Ermington, just by the Parramatta River in Sydney, was meant to be sold in 2008 but the new apartments are yet to be built.

Perhaps the Rudd and Gillard governments had good reason for taking a slower approach to land release, and perhaps the Abbott government could not restart things fast enough, but the results are sobering for anyone getting caught up in this week’s talk about housing affordability. There will always be excuses for the sluggish machinery of government but voters are in no mood to be forgiving. Why accept decades of failure when politicians keep talking about the problem?

It is now at least twice as hard to buy a first home as it was for the previous generation. Australian families needed only 3.3 times their average disposable household income to reach the median price of a house in June 1981. Now they need seven times their incomes, according to the Parliamentary Library in Canberra.

No wonder Treasury secretary John Fraser told a Senate committee last week young Australians were turning to “the bank of mum and dad” to get into the market.

This is a social time bomb. Without their own home, more Australians will grow old with the pension system stacked against them.

Why should wealthier retirees have their homes exempt from the pension assets test when others have to pay the rent out of their pension?

The more people are shut out of the housing market, the greater the pressure for change.

Morrison’s reforms to pensions and superannuation will look like the entree before an unpalatable main meal.

Bill Shorten and Chris Bowen are tapping into this frustration with their plan to clamp down on negative gearing. The Greens are doing the same.

The rise of Pauline Hanson also hints at the explosive power of this problem, as voters link their cost of living pressures with immigration and population growth. The annual migrant intake has fallen in recent years but it will not feel like that when growth is low and house prices are high.

Labor’s plan to scale back negative gearing is not a silver bullet but it means Shorten and Bowen offer a clear answer when Turnbull and Morrison do not.

Morrison hints at policies to be released. “The time for that will come down the track,” he said on Tuesday. The Assistant Minister for Cities, Angus Taylor, talked this week about the opportunities for new housing around transport hubs. Turnbull, who loves nothing more than hopping on a bus or a tram, has a palpable interest in urban renewal.

The federal agenda is now taking shape. There will be pressure on the states to release more land. The “CityDeals” policy will offer federal funding to rebuild urban areas. Transport spending will be linked to “value capture” so the increase in nearby land value can help pay for a rail line. Morrison’s competition policy plans are likely to include incentive payments to states that can prove they are delivering more housing.

The message will be that Turnbull and Morrison are doing everything they can — and that nothing is stopping the states from using the federal help to good purpose.

Whether the results come fast enough is another matter. They certainly didn’t come fast enough to save Howard in 2007.

DOLT - A person who is stupid and entirely tedious at the same time, like bwian. Oblivious to their own mental incapacity. On IGNORE - Warrior, mellie, Nom De Plume, FLEKTARD

Users browsing this forum: No registered users and 12 guests