What happens if China restricts rare earths supply ?

Forum rules

Don't poop in these threads. This isn't Europe, okay? There are rules here!

Don't poop in these threads. This isn't Europe, okay? There are rules here!

- freediver

- Posts: 3487

- Joined: Fri Dec 14, 2007 10:42 pm

- Contact:

Re: What happens if China restricts rare earths supply ?

My shares in Lynas would go up.

-

Juliar

- Posts: 1355

- Joined: Wed Dec 28, 2016 10:56 am

Re: What happens if China restricts rare earths supply ?

Australia is having a go in a small way Will China try to buy them out ?

EPA approves $900m rare earths mine in Central Australia despite radioactive risk

By Ben Millington Updated 5 Jan 2018, 8:05pm

PHOTO: Workmen next to a large bore drilling for water with water spilling onto the red earth. Arafura Resources workmen drill for water at a proposed site for the Nolan's mine project. (Supplied: Arafura Resources Ltd)

RELATED STORY: Nolans Rare Earths mine gains major project status

A proposed $900 million rare earths mine in Central Australia has been recommended for approval by the Northern Territory Environment Protection Authority (EPA), after an assessment process lasting more than two years.

Arafura Resources' Nolans Project at Aileron, 135 kilometres north-west of Alice Springs, would mine rare earth materials such as neodymium and praseodymium, used to manufacture strong magnets for wind turbines and electric vehicles.

The EPA identified several long-term environmental risks and impacts with the project, but found they could be managed.

"There will have to be a high level of operational management control for this project over a couple of generations, and there'll have to be a high level of regulatory scrutiny, there's no two ways about that," EPA chairman Paul Vogel said.

The primary risks include the permanent storage of naturally occurring radioactive material onsite and the use of significant groundwater resources over the 35 to 55-year lifespan of the project.

Mr Vogel said he understood public concern about such issues, and the effectiveness of the EPA to effectively monitor them, but said the authority was better placed to provide sufficient oversight.

"That's something that we've drawn attention to with government already, saying that we need to be adequately resourced ... to ensure that these facilities are adequately regulated over time," he said.

It is estimated the project will use 2.7 gigalitres of groundwater a year, and the EPA has recommended aquifer levels and water usage be monitored in real-time with data made available to the public.

"This includes using very conservative triggers for both water quality and quantity and condition of vegetation that are embedded in adaptive management plans, so that we don't reach a point where you've got some irreversible change to the environment," Mr Vogel said.

Radioactive material to be stored in dams

The EPA also recommended best-practice mine closure and progressive rehabilitation practices be adhered to, but noted that uncertainty remains around the significant environmental impacts over the life of the project.

PHOTO: Production bore at Arafuras' Nolan's project. The mine is expected to create up to 300 jobs. (Supplied: Arafura Resources Limited )

Arafura Resources Sustainability manager Brian Fowler said the low level radioactive material produced in the processing of rare earth material would be stored onsite in purpose-built dams.

"We're very confident those dams will secure those radioactive elements now and into the future," he said.

"They will not be a threat to the environment and they won't provide a threat to public health, and quite frankly, they are relatively stable in a normal environmental setting."

Mr Fowler said the approval of the EPA was a significant milestone for the project, which began 10 years ago.

"What it'll enable us to do now is to go forward and do our detailed mine planning which will then lead us to financial investment decision in the late part of this year with a view to then starting construction, assuming we can attract the required financing, in 2019," he said.

The company said the project would create an investment of about $900 million in Central Australia, as well as 250 to 300 permanent jobs.

Mr Fowler said the company intended to target local people for employment where possible, with the view to creating intergenerational change in the community.

"We understand that there'll be significant challenges in doing that, but when you've got a mine life that contemplates 35 to 55 years, it gives you the opportunity to do lots of planning and work with stakeholders to ensure those benefits are realised," he said.

PHOTO: An aerial shot of the proposed mine site showing multiple bores. The proposed site is 135 kilometres northwest of Alice Springs and 10 kilometres west of Aileron roadhouse and Alyuen community. (Supplied: Arafura Resources Ltd)

https://www.abc.net.au/news/2018-01-05/ ... ia/9306610

EPA approves $900m rare earths mine in Central Australia despite radioactive risk

By Ben Millington Updated 5 Jan 2018, 8:05pm

PHOTO: Workmen next to a large bore drilling for water with water spilling onto the red earth. Arafura Resources workmen drill for water at a proposed site for the Nolan's mine project. (Supplied: Arafura Resources Ltd)

RELATED STORY: Nolans Rare Earths mine gains major project status

A proposed $900 million rare earths mine in Central Australia has been recommended for approval by the Northern Territory Environment Protection Authority (EPA), after an assessment process lasting more than two years.

Arafura Resources' Nolans Project at Aileron, 135 kilometres north-west of Alice Springs, would mine rare earth materials such as neodymium and praseodymium, used to manufacture strong magnets for wind turbines and electric vehicles.

The EPA identified several long-term environmental risks and impacts with the project, but found they could be managed.

"There will have to be a high level of operational management control for this project over a couple of generations, and there'll have to be a high level of regulatory scrutiny, there's no two ways about that," EPA chairman Paul Vogel said.

The primary risks include the permanent storage of naturally occurring radioactive material onsite and the use of significant groundwater resources over the 35 to 55-year lifespan of the project.

Mr Vogel said he understood public concern about such issues, and the effectiveness of the EPA to effectively monitor them, but said the authority was better placed to provide sufficient oversight.

"That's something that we've drawn attention to with government already, saying that we need to be adequately resourced ... to ensure that these facilities are adequately regulated over time," he said.

It is estimated the project will use 2.7 gigalitres of groundwater a year, and the EPA has recommended aquifer levels and water usage be monitored in real-time with data made available to the public.

"This includes using very conservative triggers for both water quality and quantity and condition of vegetation that are embedded in adaptive management plans, so that we don't reach a point where you've got some irreversible change to the environment," Mr Vogel said.

Radioactive material to be stored in dams

The EPA also recommended best-practice mine closure and progressive rehabilitation practices be adhered to, but noted that uncertainty remains around the significant environmental impacts over the life of the project.

PHOTO: Production bore at Arafuras' Nolan's project. The mine is expected to create up to 300 jobs. (Supplied: Arafura Resources Limited )

Arafura Resources Sustainability manager Brian Fowler said the low level radioactive material produced in the processing of rare earth material would be stored onsite in purpose-built dams.

"We're very confident those dams will secure those radioactive elements now and into the future," he said.

"They will not be a threat to the environment and they won't provide a threat to public health, and quite frankly, they are relatively stable in a normal environmental setting."

Mr Fowler said the approval of the EPA was a significant milestone for the project, which began 10 years ago.

"What it'll enable us to do now is to go forward and do our detailed mine planning which will then lead us to financial investment decision in the late part of this year with a view to then starting construction, assuming we can attract the required financing, in 2019," he said.

The company said the project would create an investment of about $900 million in Central Australia, as well as 250 to 300 permanent jobs.

Mr Fowler said the company intended to target local people for employment where possible, with the view to creating intergenerational change in the community.

"We understand that there'll be significant challenges in doing that, but when you've got a mine life that contemplates 35 to 55 years, it gives you the opportunity to do lots of planning and work with stakeholders to ensure those benefits are realised," he said.

PHOTO: An aerial shot of the proposed mine site showing multiple bores. The proposed site is 135 kilometres northwest of Alice Springs and 10 kilometres west of Aileron roadhouse and Alyuen community. (Supplied: Arafura Resources Ltd)

https://www.abc.net.au/news/2018-01-05/ ... ia/9306610

-

Juliar

- Posts: 1355

- Joined: Wed Dec 28, 2016 10:56 am

Re: What happens if China restricts rare earths supply ?

Will Australia be able to capitalize on rare earth supplies ?

Why everyone’s talking about Australia’s rare earth

Killian Plastow 10:05pm, Dec 8, 2019 Updated: 8:17pm, Dec 8

Lithium in lepidolite form. Lithium is just one of a number of rare earth elements Australia can capitalise on. Photo: Getty

The world’s supply of rare earth elements has become a casualty of the US’s trade war with China, leaving Australia to pick up the slack.

The 17 elements – used in a range of new and emerging technologies like electric car batteries and specialised computer chips – are rapidly becoming a key commodity in global trade.

Resources Minister Matthew Canavan said they provide “huge scope” for Australia to capitalise on that growing demand.

In November, Australia took a huge step towards making that a reality when Geoscience Australia and its American equivalent – the US Geological Survey (USGS) – struck a deal to develop resources and supply chains.

“The US has a need for critical minerals and Australia’s abundant supplies makes us a reliable and secure international supplier of a wide range of those, including rare earth elements,” Mr Canavan said.

What are rare earth elements?

‘Rare earth elements’ is a term applied to 17 metals used in the production of electronics.

Perhaps the best known of these elements is lithium, a core component of electric car batteries.

Despite their name, these elements aren’t particularly uncommon, with one of the 17, Cesium, actually the 25th most abundant crustal element on the planet.

The name instead refers to the fact these elements are rarely found in large enough concentrations to support a commercial mine, making it difficult to produce them on an industrial scale.

What do they mean for Australia?

A report by Geoscience Australia, based on data compiled by USGS, estimates the market for rare earth elements is worth around $24.3 billion annually, and Australia can increase its share of that pie.

Mining Council of Australia chief executive Tania Constable said Australia has “significant rare earth element resources, which could sustain several key mines for decades”.

“One example of such a mine is Arafura Resources Nolans Project in the Northern Territory, which will attract $1 billion of investment into regional Australia and create hundreds of local jobs.”

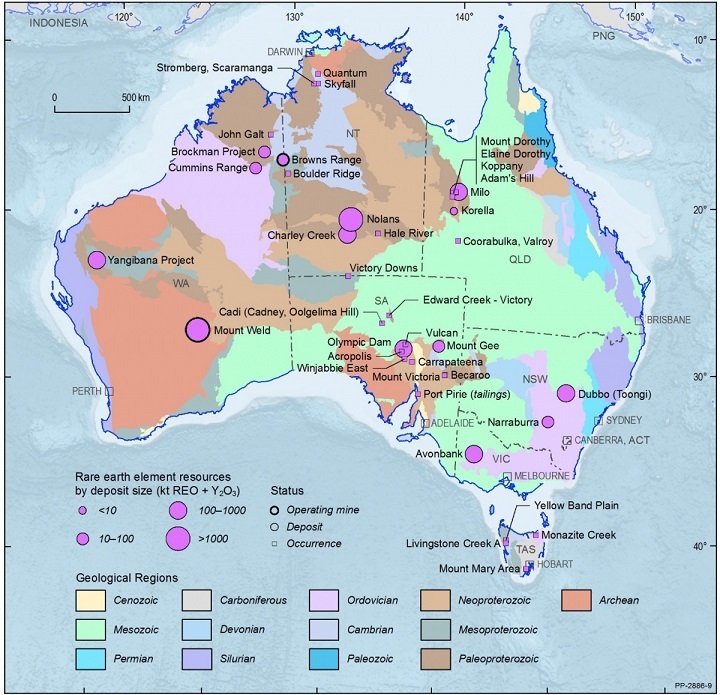

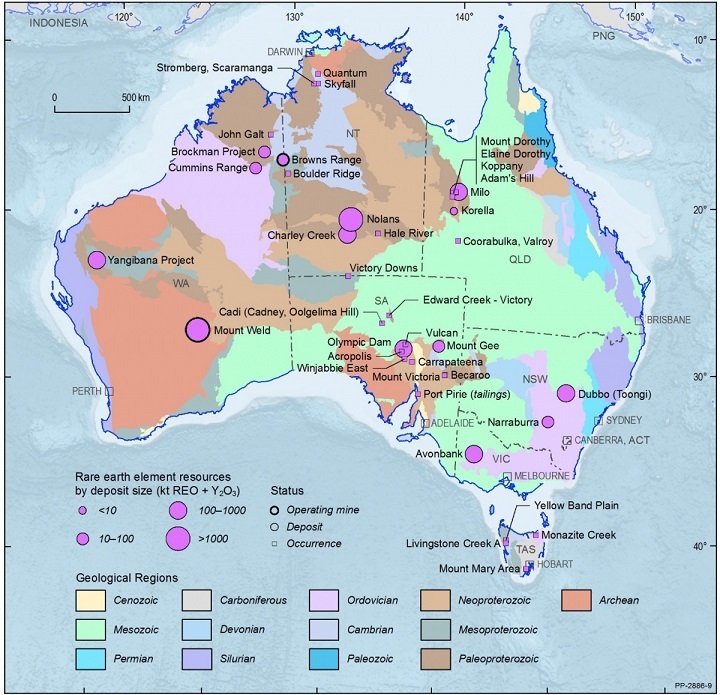

A map showing Australian rare earth mines.

The demand for rare earth elements also comes at a time when demand for Australian coal – a $67 million-a-year cash cow that represents more than 15 per cent of Australian exports – is plummeting.

Miners BHP and Rio Tinto have called time on coal projects, and Glencore has placed a cap on production.

What’s the global market like?

The market for rare earth elements is controlled by China, which accounts for somewhere between 85 and 90 per cent of the supply chain, according to CommSec mining and energy commodities research director Vivek Dhar.

Australia and the US are the two next largest producers, but China’s “lax environmental regulations and cheaper costs” mean the nation’s grip on the rare element market is well and truly “entrenched”.

“It is worth noting that China’s control over supply has been directly responsible for the previous spikes in rare earth prices,” Mr Dhar said.

“In 2011, China ramped up restrictions on rare earth exports, which led to a significant market shortage and a spike in rare earth prices that peaked almost three times higher than today’s price.

“China’s 15 years of export restrictions finally came to an end at the beginning of 2015 after the World Trade Organisation ruled against the practice. Prices subsequently trended slightly lower.

“In 2017, rare earth prices rose 55 to 60 per cent higher than today’s level after China reduced domestic rare earth production and processing as authorities enforced environmental regulations more rigorously.”

Prices skyrocketed earlier this year too, rising between 20 and 25 per cent as the US’s on-again, off-again trade war left market participants worried China may clamp down on its exports.

https://thenewdaily.com.au/finance/fina ... australia/

Why everyone’s talking about Australia’s rare earth

Killian Plastow 10:05pm, Dec 8, 2019 Updated: 8:17pm, Dec 8

Lithium in lepidolite form. Lithium is just one of a number of rare earth elements Australia can capitalise on. Photo: Getty

The world’s supply of rare earth elements has become a casualty of the US’s trade war with China, leaving Australia to pick up the slack.

The 17 elements – used in a range of new and emerging technologies like electric car batteries and specialised computer chips – are rapidly becoming a key commodity in global trade.

Resources Minister Matthew Canavan said they provide “huge scope” for Australia to capitalise on that growing demand.

In November, Australia took a huge step towards making that a reality when Geoscience Australia and its American equivalent – the US Geological Survey (USGS) – struck a deal to develop resources and supply chains.

“The US has a need for critical minerals and Australia’s abundant supplies makes us a reliable and secure international supplier of a wide range of those, including rare earth elements,” Mr Canavan said.

What are rare earth elements?

‘Rare earth elements’ is a term applied to 17 metals used in the production of electronics.

Perhaps the best known of these elements is lithium, a core component of electric car batteries.

Despite their name, these elements aren’t particularly uncommon, with one of the 17, Cesium, actually the 25th most abundant crustal element on the planet.

The name instead refers to the fact these elements are rarely found in large enough concentrations to support a commercial mine, making it difficult to produce them on an industrial scale.

What do they mean for Australia?

A report by Geoscience Australia, based on data compiled by USGS, estimates the market for rare earth elements is worth around $24.3 billion annually, and Australia can increase its share of that pie.

Mining Council of Australia chief executive Tania Constable said Australia has “significant rare earth element resources, which could sustain several key mines for decades”.

“One example of such a mine is Arafura Resources Nolans Project in the Northern Territory, which will attract $1 billion of investment into regional Australia and create hundreds of local jobs.”

A map showing Australian rare earth mines.

The demand for rare earth elements also comes at a time when demand for Australian coal – a $67 million-a-year cash cow that represents more than 15 per cent of Australian exports – is plummeting.

Miners BHP and Rio Tinto have called time on coal projects, and Glencore has placed a cap on production.

What’s the global market like?

The market for rare earth elements is controlled by China, which accounts for somewhere between 85 and 90 per cent of the supply chain, according to CommSec mining and energy commodities research director Vivek Dhar.

Australia and the US are the two next largest producers, but China’s “lax environmental regulations and cheaper costs” mean the nation’s grip on the rare element market is well and truly “entrenched”.

“It is worth noting that China’s control over supply has been directly responsible for the previous spikes in rare earth prices,” Mr Dhar said.

“In 2011, China ramped up restrictions on rare earth exports, which led to a significant market shortage and a spike in rare earth prices that peaked almost three times higher than today’s price.

“China’s 15 years of export restrictions finally came to an end at the beginning of 2015 after the World Trade Organisation ruled against the practice. Prices subsequently trended slightly lower.

“In 2017, rare earth prices rose 55 to 60 per cent higher than today’s level after China reduced domestic rare earth production and processing as authorities enforced environmental regulations more rigorously.”

Prices skyrocketed earlier this year too, rising between 20 and 25 per cent as the US’s on-again, off-again trade war left market participants worried China may clamp down on its exports.

https://thenewdaily.com.au/finance/fina ... australia/

- Black Orchid

- Posts: 26313

- Joined: Sun Sep 25, 2011 1:10 am

Re: What happens if China restricts rare earths supply ?

Maybe I should be buying shares in companies who mine rare earth deposits.

- BigP

- Posts: 4970

- Joined: Mon Mar 19, 2018 3:56 pm

Re: What happens if China restricts rare earths supply ?

Certainly dodgier investments you could get yourself involved inBlack Orchid wrote: ↑Mon Dec 09, 2019 2:22 pmMaybe I should be buying shares in companies who mine rare earth deposits.

-

Juliar

- Posts: 1355

- Joined: Wed Dec 28, 2016 10:56 am

Re: What happens if China restricts rare earths supply ?

The danger is that China will flood the market again and undercut these Australian higher cost attempts.

It would appear there is a big difference between just mining these rare earths and actually processing them to commercially usable form.

Recall China's poisonous black lake in Mongolia where they use acid leaching to eventually extract the rare earths.

Lynas supposedly has a more civilized way of extracting the rare earths but they have had trouble with the Malaysian environmental police.

Lynas is doing some sort of deal in Texas.

It would appear there is a big difference between just mining these rare earths and actually processing them to commercially usable form.

Recall China's poisonous black lake in Mongolia where they use acid leaching to eventually extract the rare earths.

Lynas supposedly has a more civilized way of extracting the rare earths but they have had trouble with the Malaysian environmental police.

Lynas is doing some sort of deal in Texas.

- BigP

- Posts: 4970

- Joined: Mon Mar 19, 2018 3:56 pm

Re: What happens if China restricts rare earths supply ?

""The danger is that China will flood the market again and undercut these Australian higher cost attempts.""Juliar wrote: ↑Mon Dec 09, 2019 5:04 pmThe danger is that China will flood the market again and undercut these Australian higher cost attempts.

It would appear there is a big difference between just mining these rare earths and actually processing them to commercially usable form.

Recall China's poisonous black lake in Mongolia where they use acid leaching to eventually extract the rare earths.

Lynas supposedly has a more civilized way of extracting the rare earths but they have had trouble with the Malaysian environmental police.

Lynas is doing some sort of deal in Texas.

No they wont do that, because peeps will buy it up and store it for a rainy day, and they will lose their leverage

-

Juliar

- Posts: 1355

- Joined: Wed Dec 28, 2016 10:56 am

Re: What happens if China restricts rare earths supply ?

BigP, forgets it costs heaps to just mine the rare earths let alone then just store it. So the money would soon run out.

China can easily flood the market as they have done before as China has a gigantic rare earths mine and acid leaching installation in Mongolia which produces commercially ready rare earths.

And China's production cost is MUCH less than anything Australia could come up with. And also China does not have the Greenies to contend with.

So be wary of buying any Australian rare earths mining shares. LYNAS has been trying for years to be successful.

China can easily flood the market as they have done before as China has a gigantic rare earths mine and acid leaching installation in Mongolia which produces commercially ready rare earths.

And China's production cost is MUCH less than anything Australia could come up with. And also China does not have the Greenies to contend with.

So be wary of buying any Australian rare earths mining shares. LYNAS has been trying for years to be successful.

- BigP

- Posts: 4970

- Joined: Mon Mar 19, 2018 3:56 pm

Re: What happens if China restricts rare earths supply ?

""BigP, forgets it costs heaps to just mine the rare earths let alone then just store it. So the money would soon run out.""Juliar wrote: ↑Mon Dec 09, 2019 6:14 pmBigP, forgets it costs heaps to just mine the rare earths let alone then just store it. So the money would soon run out.

China can easily flood the market as they have done before as China has a gigantic rare earths mine and acid leaching installation in Mongolia which produces commercially ready rare earths.

And China's production cost is MUCH less than anything Australia could come up with. And also China does not have the Greenies to contend with.

So be wary of buying any Australian rare earths mining shares. LYNAS has been trying for years to be successful.

Little j, dont ever get it into that little head of yours that you have any idea what the fuck it is that I may or may not have forgotten , I was starting to warm a little towards you until you opened ya big gob and showed how ignorant you are

-

Juliar

- Posts: 1355

- Joined: Wed Dec 28, 2016 10:56 am

Re: What happens if China restricts rare earths supply ?

BigP sorry if I ruffled your feathers but I concentrate on the FACTS rather than fantasy.

Shares are unforgiving and so an unwise purchase can cost lots when it fails to deliver.

Shares are unforgiving and so an unwise purchase can cost lots when it fails to deliver.

Who is online

Users browsing this forum: No registered users and 12 guests